Skyrocket your revenue with a Vitaminise Mobile App empowered with self-service features and artificial intelligence

Book a demo

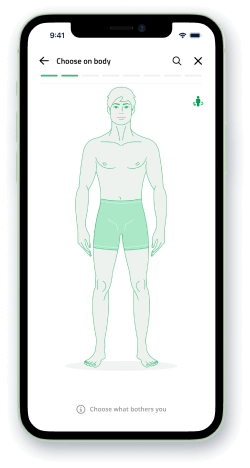

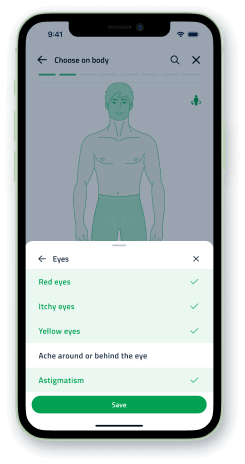

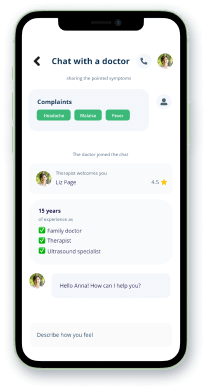

The insured can report current symptoms by selecting them from a list of body avatars. Natural Language Processing helps understand patient inputs, inform about possible diagnoses, and receive a recommendation for which specialty of doctor to schedule an appointment with.

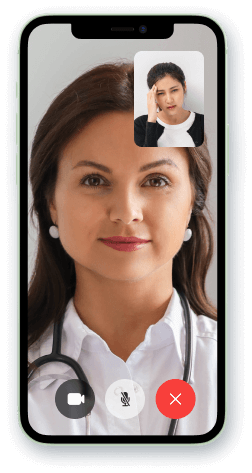

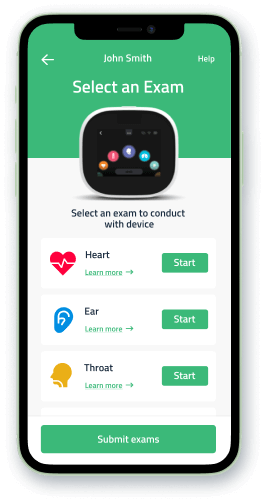

The insured can connect with doctors online instantly and get consultations, treatment plans, prescriptions, or referrals for additional exams. Moreover, more accurate diagnoses can be determined by utilizing an extended feature with clinical-grade remote physical exam devices.

Insurers can extract policy numbers, incident descriptions, dates, and other necessary information for claims registration from customer conversations in real-time. Moreover, insurers can verify a caller's voiceprint against known fraudsters, allowing for the immediate detection and identification of fraud.

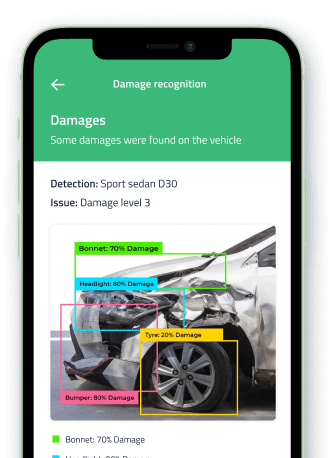

This technology can detect fraud by analyzing the person's authenticity, monitoring driving behavior through telematics and video, and assessing claims by analyzing video proofs.

With image recognition technology, users can assess damage (property or vehicles), whereas insurers can improve underwriting by identifying details affecting risk profiles and fraud detection.

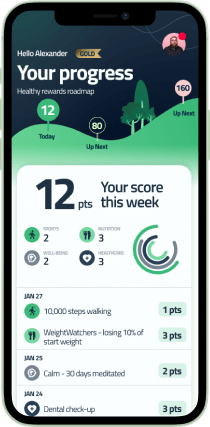

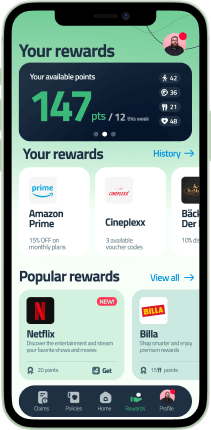

Promote a healthy lifestyle and decrease the cost of claims. Insurers can encourage customers to lead a healthy life by participating in various programs and challenges and earning points for this. These points can be exchanged for discounts, gifts, free courses, health check-ups, and more.

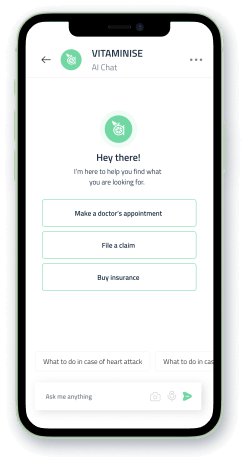

Vitaminise chatbot understands context, recognizes voice and written messages and allows clients to buy a policy or file a claim. The chatbot can communicate in multiple languages simultaneously.

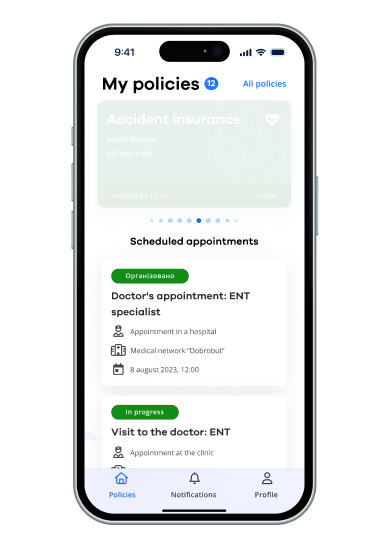

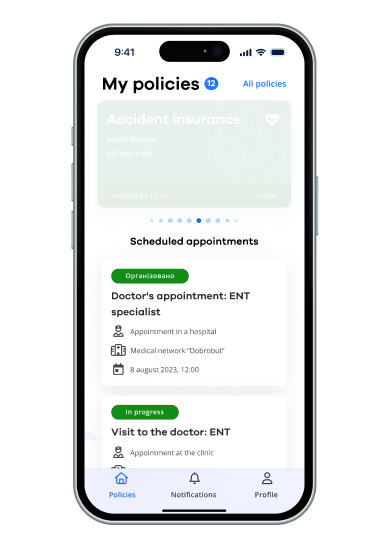

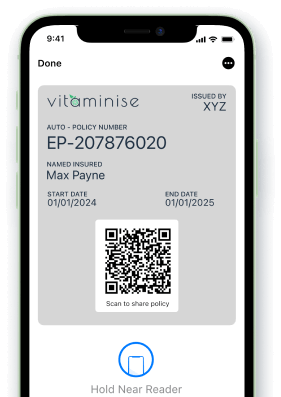

Policyholders can keep insurance cards in a digital wallet and use their policies whenever and wherever they need. Digital insurance cards can be added to Apple Wallet and Google Wallet via an ID card management functionality of the insurance company’s mobile app. Keeping cards in one secure and easily accessible place is convenient for customers, which results in enhanced customer satisfaction and loyalty.

By integrating a mobile application with portable devices for patient examination, the insurance company will be able to provide medical examinations by clinical staff online, regardless of where the insured is and what illness he/she has—acute or chronic. Such examinations may include, for example, listening to heart and lung sounds, examining the ear and throat, measuring blood pressure, blood oxygen level, and other parameters. In addition, such solutions work on artificial intelligence and help doctors in decision-making.

If you already have a mobile app, but want to refresh it with advanced functionality, we will help you find out what feature will benefit your business most.

Send your requestThe Vitaminise pricing model consists of three components: base fee, module-specific fee, and support. A customization option is available and is calculated separately. It consists of a discovery phase and customization itself.

A fixed fee that covers general access to the platform and all core features that come with all modules

Additional fees for each module that the insurance company activates

Includes fee for technical support and functionality extension

Discovery phase:

Mobile app customized according to requirements for two platforms, iOS and Android, tested and published in AppStore and Google Play Market

Vitaminise Mobile Application reduces operational costs, improves customer engagement, and drives revenue growth by providing convenient self-service functionalities to users and up/cross-selling capabilities for insurers.

Vitaminise works mainly with A&H and P&C insurance business lines. However, our solutions can be implemented for other lines, as well.

Yes, Vitaminise will be integrated with your particular core system through specific APIs for maximum efficiency and flexibility.

Yes, it is. Users can easily choose and buy policies online by paying through an online payment system, Google Pay or Apple Pay.

Yes, it is possible to file claims through Vitaminise Mobile App by providing incident details and uploading supporting documents, photos, and videos.

First, you should consult our experts on what license will work better for your business and discuss your current challenges, business goals, and needs. Right now, you can schedule a demo session with our team to see all Vitaminise features and their advantages for your company.

There are no comparable ready-made licensed solutions like Vitaminise in the insurance market. While some insurers develop custom apps, they lack the functionality and flexibility of our product. In-house development by insurers is significantly more expensive and time-consuming, while custom software development firms tend to offer solutions that are similarly costly and take longer to implement.

Core insurance platform vendors also offer mobile solutions. Still, since mobile applications aren't their primary focus, these tend to be underdeveloped and lack the necessary flexibility to meet changing customer needs.

Vitaminise uses advanced technologies, including AI, and incorporates deep insurance expertise. It's a modular, native iOS and Android solution for life and non-life insurance. It allows insurers to quickly tailor it to their needs without the delays typical of in-house development.

Surely, Vitaminise Mobile App will be customized according to your company's branding, Tone of Voice, design system, etc. More robust customization (development of additional features, integration with APIs, etc.) is also available and includes a discovery phase.

Yes, technical support is provided on a yearly fee basis. It includes not only regular updates and bug fixes but also guaranteed access to professional team support responding to the incidents according to the severity level in a chosen communication channel and providing consultations on functionality when needed.

Vitaminise Mobile App is a B2B SaaS solution providing unique digital functionalities for insurers through subscription-based licensing, implementation fees, and ongoing support services. Currently, base fee licenses, module-specific fee licenses, support, and customization are available for insurance companies worldwide.