Claims processing is the mission-critical part of any insurance handling routine, and health policies are no exception. Health insurance claims management solutions are highly instrumental at all stages of this procedure – from submitting a claim through its processing to a compensation payment.

Benefits of custom health insurance claims management software

Leveraging a first-rate claims management product ushers in some weighty boons for insurance organizations and their customers.

Get a free consultation on your project!

Basic features of custom health insurance claims management software

The best-in-class custom solution should perform all claims management functions in health insurance, such as:

Why choose DICEUS for health insurance claims management software development?

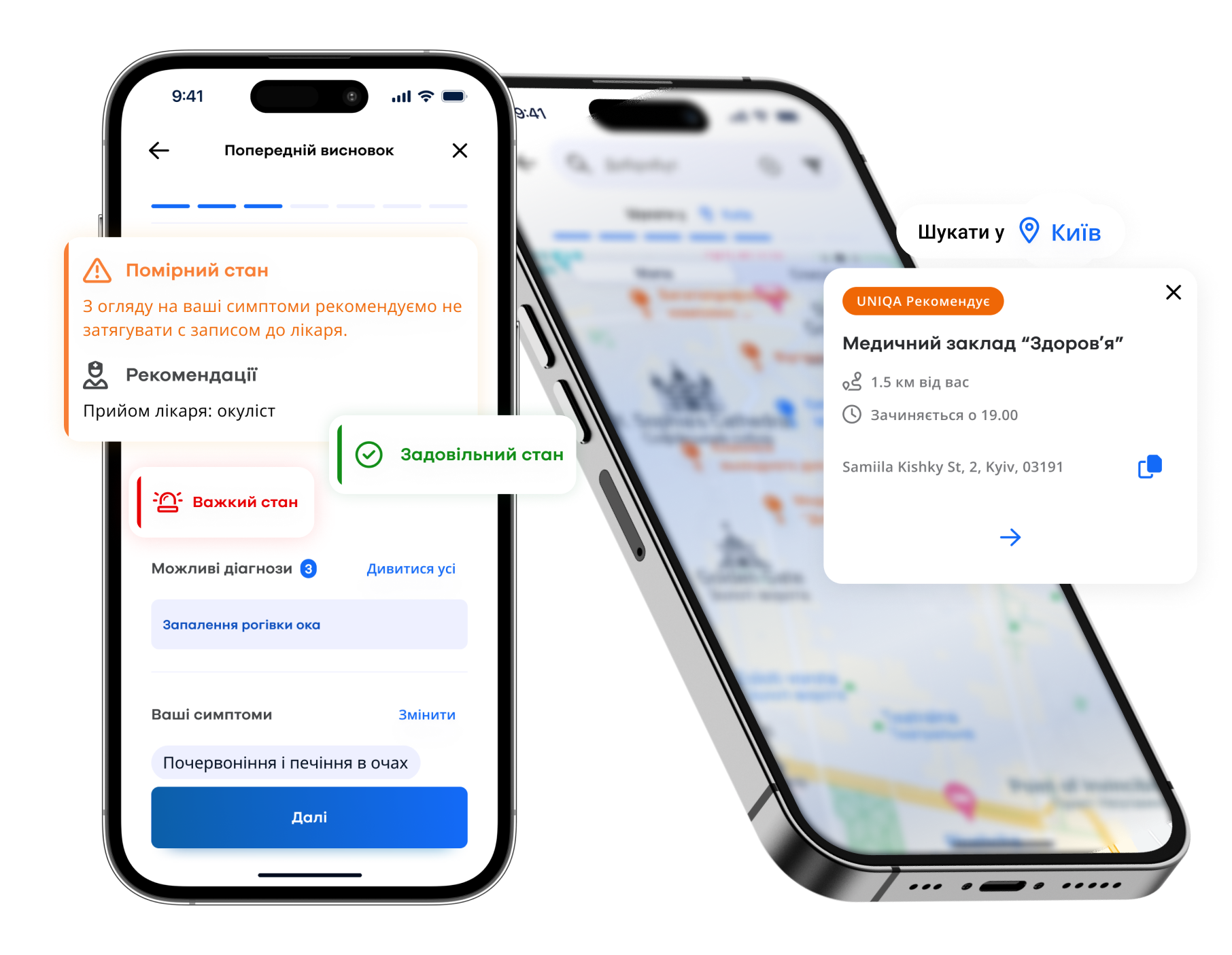

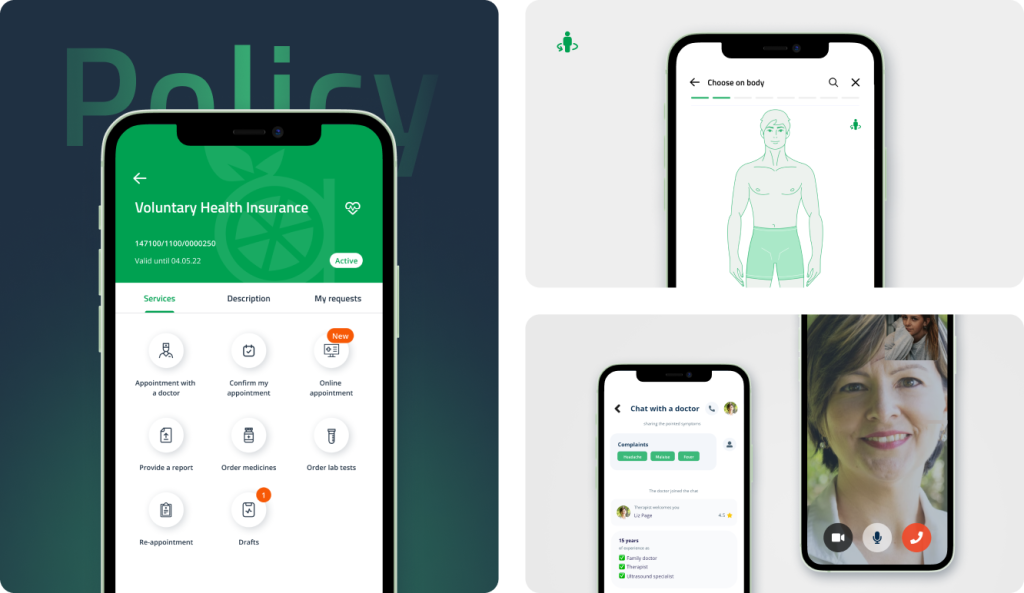

- Over 20 insurance software projects completed for such blue-chip actors in the realm as UNIQA, Willis, BriteCore, and BenefitNet

- Voluminous tech stack that includes classic frameworks, tools, and languages together with state-of-the-art technologies

- 250 qualified IT employees in command of the necessary skills

- A well-thought-out SDLC where developers are assigned clearly established responsibilities and roles

- The customer-oriented approach, enabling us to readily adjust to our partners’ preferences regarding interaction channels and communication schedule

About DICEUS

Our services

The vetted experts of DICEUS provide the entire range of custom health insurance claims management software development services that cover all IT needs of an insurance company in this domain.

Custom software development

We can create comprehensive insurance claims management software from scratch. Our SDLC covers all necessary stages, starting with the discovery phase and project planning and ending up with the deployment of insurance solutions with subsequent support and maintenance services.

Legacy system modernization

If you rely on an out-of-date ecosystem whose inadequate functioning hampers your efficiency and fails to satisfy its users’ expectations, we will conduct its out-and-out audit, pinpoint areas that underperform, and upgrade or replace them with cutting-edge features and tools.

Mobile app development

Modern insurance organizations can’t ignore the mobile experience of their clientele. DICEUS will create a robust app that will let people file a claim from wherever they are and receive the complete roster of other health insurance services via their smartphone.

Web portal development

We will build an insurance portal where all stakeholders can communicate and obtain not only claims management services but also acquire policies, perform underwriting, get answers to FAQs, enjoy self-service opportunities, access data analytics, exchange medical information with hospitals, etc.

Integration services

The claims management process in health insurance is only one element of the complex routine. We will join all shop floor activities within one IT ecosystem by seamlessly integrating respective tools and solutions via a network of APIs so that its components play well with each other.

Want to discuss your project?

Check out our solutions for insurance

Client reviews

Our case studies

FAQ

What is health insurance claims management software?

It is a complex of IT products that insurance companies leverage to streamline and facilitate the health claim management pipeline. The ecosystem covers all aspects of claim handling, including claim filing, claim progress tracking, document management, online payments, and more.

How does claims adjudication software contribute to health insurance processes?

Solutions of this kind automate the lion’s share of related workflows, such as claims adjudication and auto-adjudication, benefit administration, enrollments, and billing. Thanks to them, insurance organizations can quickly and efficiently assess claims for coverage, medical necessity, and contract agreements.

How can patient billing and claims software improve financial workflows?

By integrating this module into their professional IT environment, insurance companies boost their financial workflows due to enhanced accuracy, error minimization, facilitated cash flow, perpetual regulatory compliance, and improved financial reporting capabilities.

What technologies and trends drive digital claims processing in health insurance?

Artificial Intelligence is the principal technology that will shape the contours of claim processing in health insurance in the foreseeable future. Its chief use case in the niche is fraud detection and prevention through firm billing control. Besides, AI will surely become an intelligent instrument for checking claims against prewired codes, policies, or providers and powering chatbots that will radically boost customer service.

What benefits does claims workflow automation technology bring to healthcare providers?

Companies that introduce a high degree of automation into their claims handling pipeline minimize the negative effect of human factors (errors, oversights, and negligence), improve the organization’s efficiency and productivity, step up risk management, provide non-stop regulatory and SLA compliance, and augment the overall level of services they offer.