Teambase is a multinational company with risk management, insurance, and advisory services.

Project overview

Client information

-

Team composition

8 members

-

Client name

Teambase DMCC

-

Expertise used

-

Duration

10 months

-

Services provided

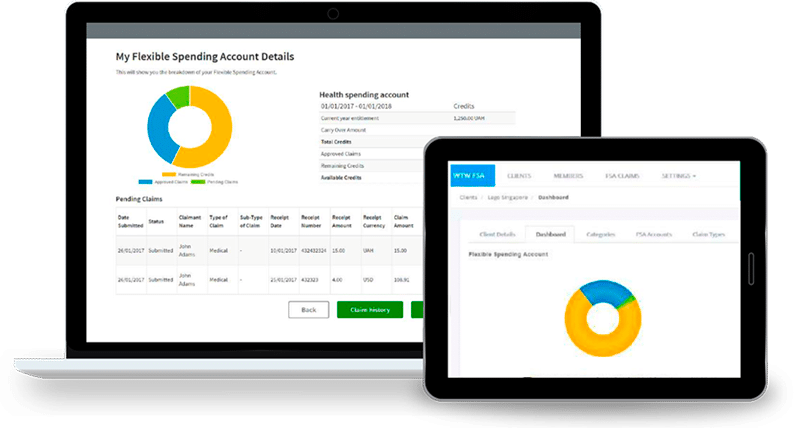

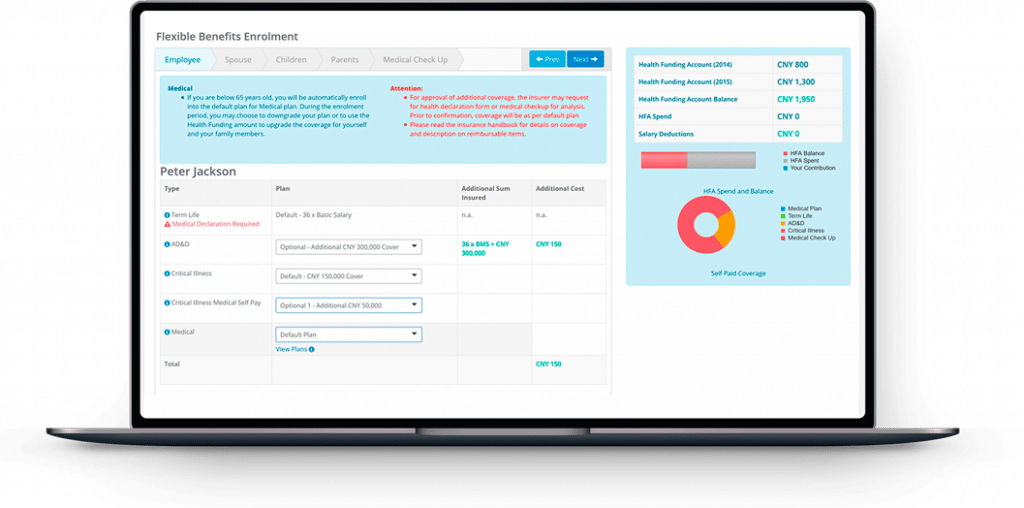

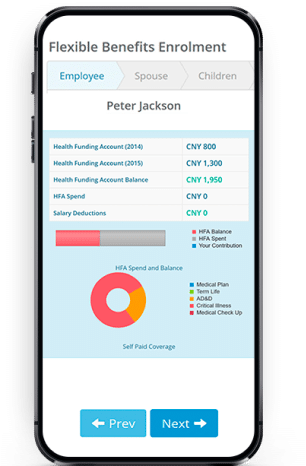

Software architecture, UI/UX design, Custom software development, Software support

-

Country

United Arab Emirates

-

Industry