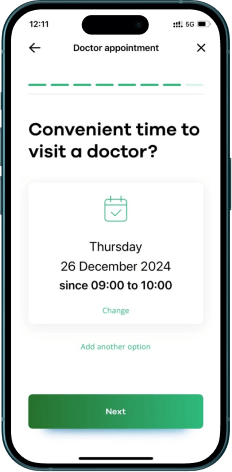

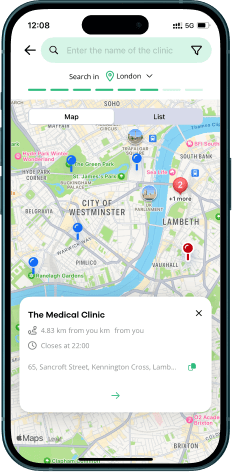

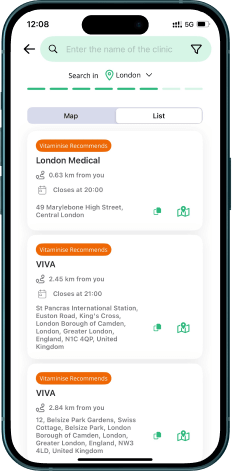

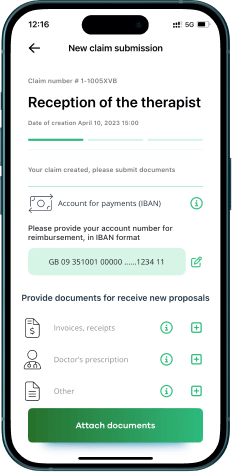

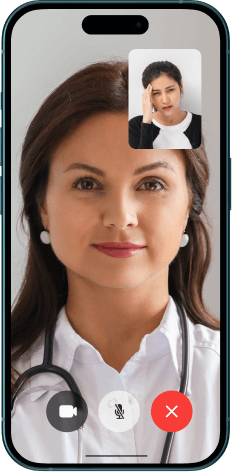

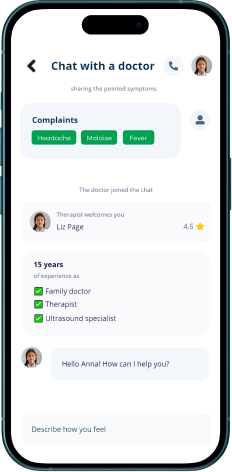

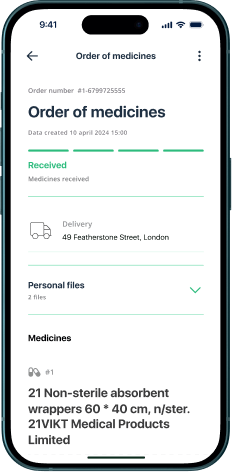

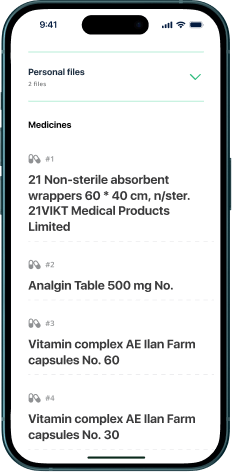

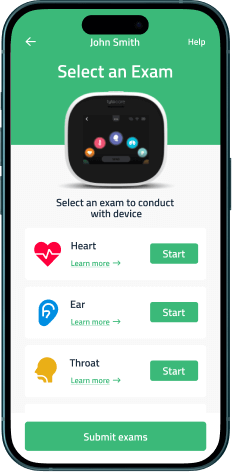

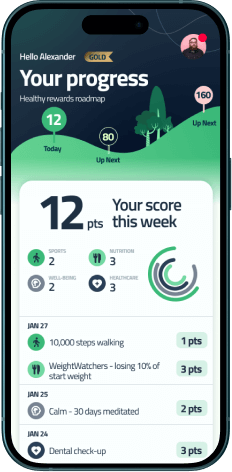

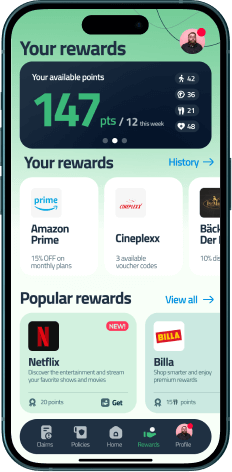

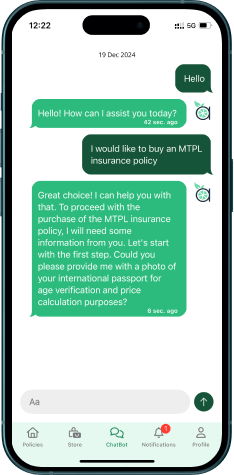

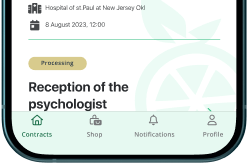

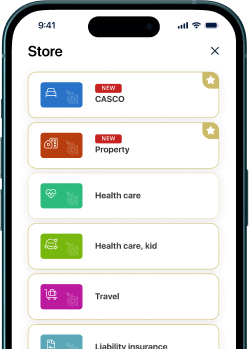

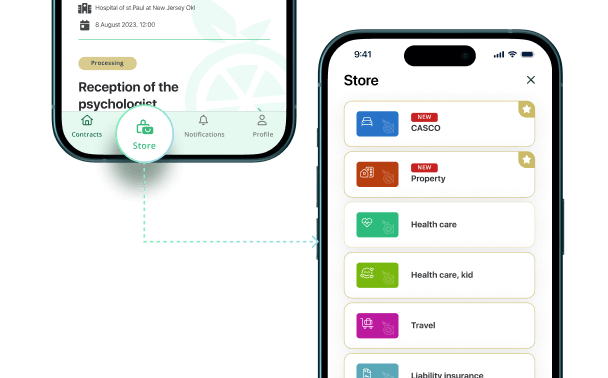

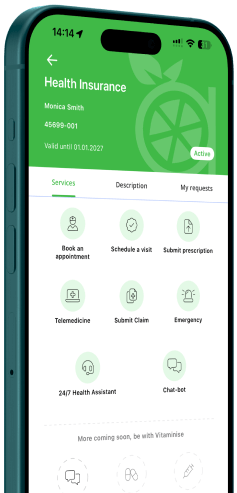

Vitaminise Mobile App for Health Insurance Companies

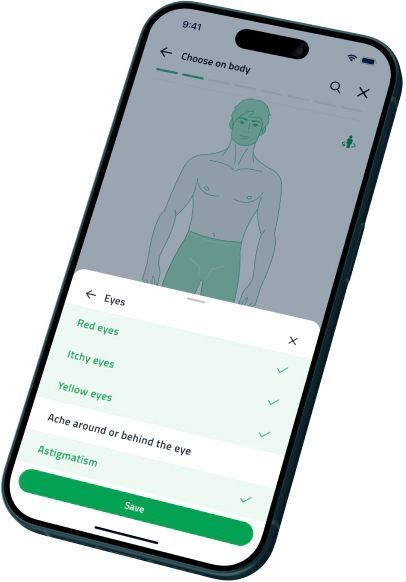

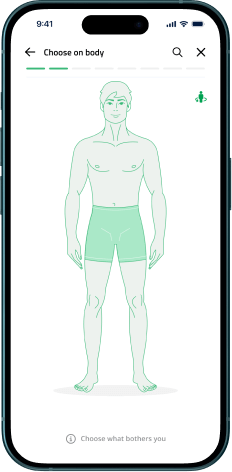

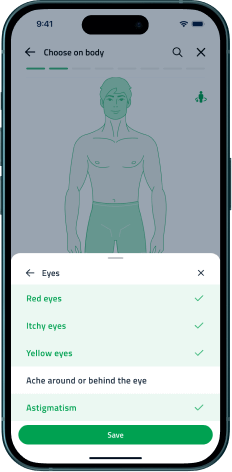

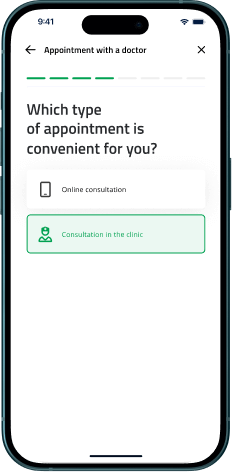

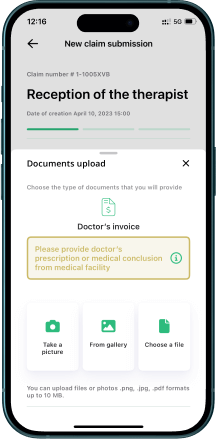

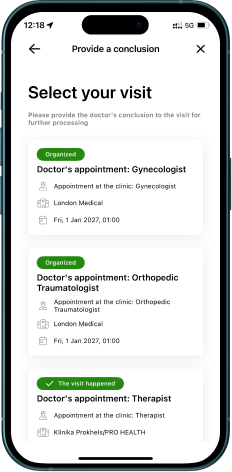

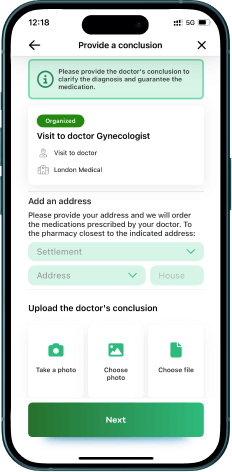

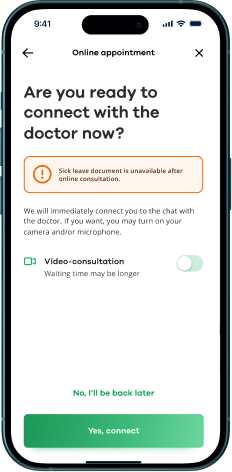

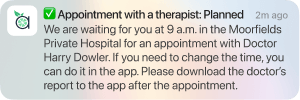

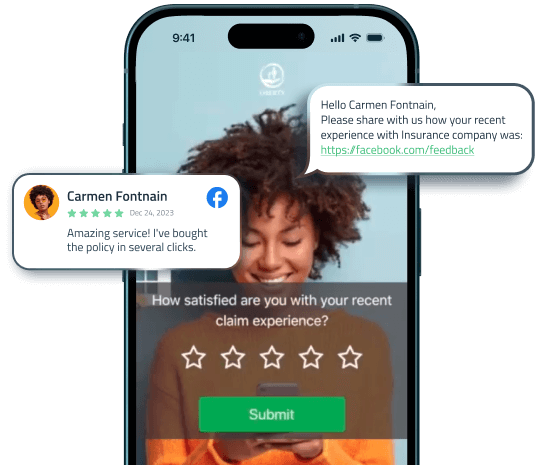

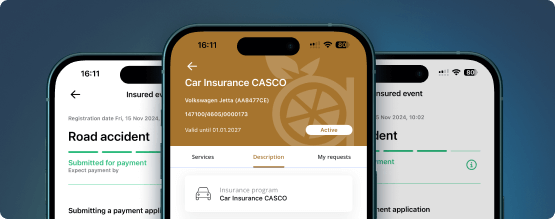

Vitaminise Mobile App is a multilingual native iOS and Android-based mobile application built for insurance companies. It delivers a first-class customer experience for policyholders and automates key insurance processes, including claims submission, policy purchase, and document processing.

Book a demo