Being a vetted player in the niche of insurance portal software development, DICEUS has accumulated profound theoretical knowledge and vast hands-on experience in this domain. Our high-profile specialists employ a wide array of cutting-edge tools to deliver a comprehensive online insurance platform combining an insurance supplier portal and a customer-facing solution that will meet the requirements of companies and satisfy the most fastidious consumer needs.

Contemporary insurance portals are virtual venues where insurance agents, brokers, and clients come into contact to offer and obtain an entire roster of insurance policies (life, health, property, etc.) and related services. Insurance portal implementation enables organizations in the industry to streamline and facilitate their workflow, increase productivity, and provide a high level of customer satisfaction to their clientele.

DICEUS approach to custom insurance portal development

Our custom insurance portal software meets the top quality standards in the field because we prioritize the following principles in the process of web portal development.

In-depth customer experience (CX) research

This is the mission-critical preliminary stage of our SDLC. During it, we discover consumer preferences, interests, and pain points to provide the best-in-class design and appropriate software architecture that will guarantee a seamless experience for insurance service consumers.

Tailor-made features to meet user expectations

We meticulously follow all the guidelines set by each customer regarding the unique list of features and capabilities the future insurtech product will have in accordance with the scope of services the organization offers.

Fully customizable solution

Our team fine-tunes insurance portal software to let it play well with the digital ecosystem of the customer and align with the company’s business requirements, needs, and vision for future growth. The final solution can also be customized according to your branding, tone of voice, and other corporate aspects.

Focus on omnichannel CX

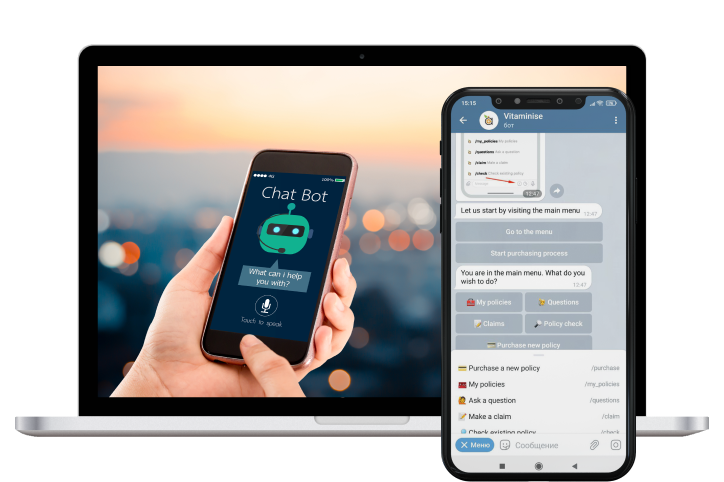

Modern insurance providers’ customers leverage various channels and devices to buy a policy, submit a claim, or obtain compensation. Realizing this, we aim to provide an integrated experience that will ensure the same quality of services, no matter whether the client reaches out to them via a mobile gadget, laptop, or desktop.

Let’s discuss your project needs.

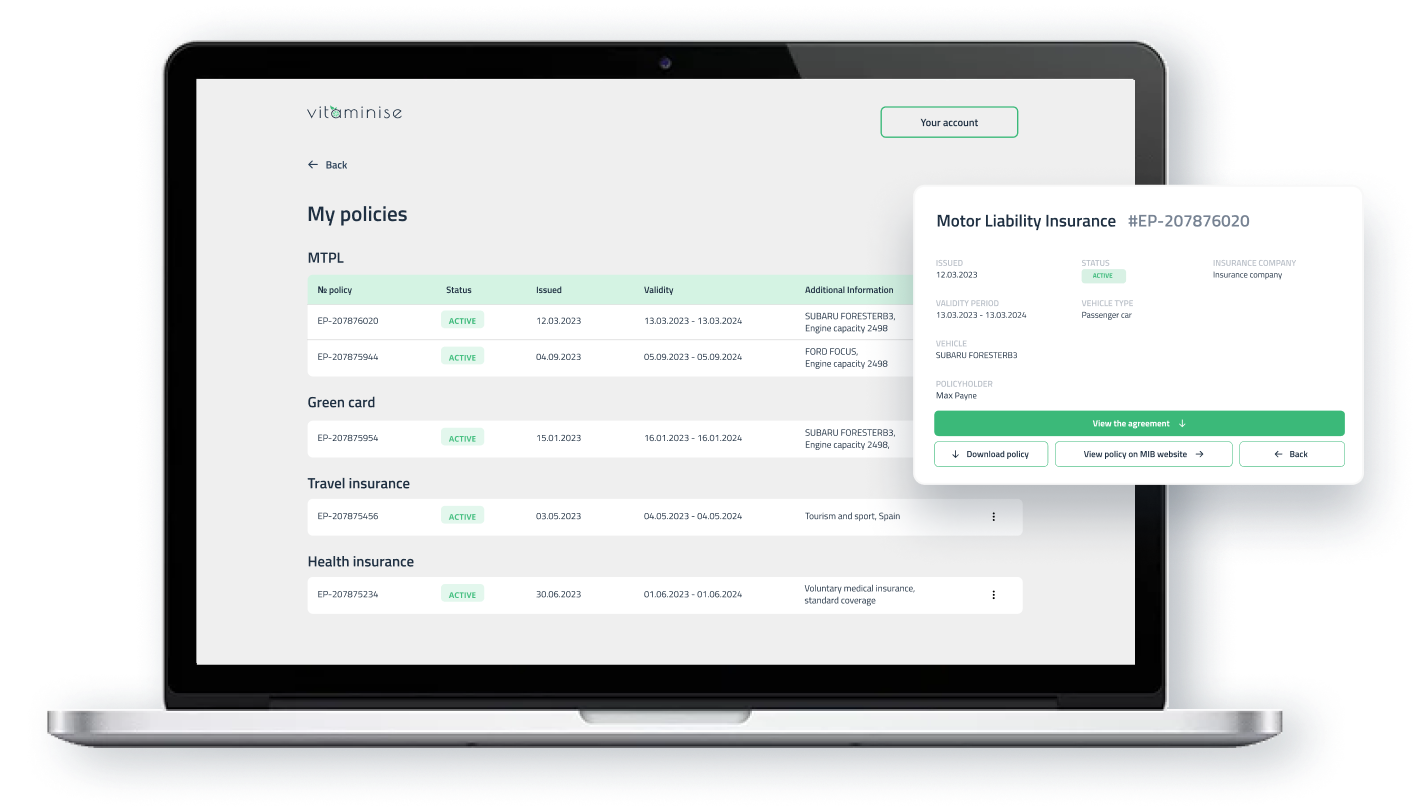

Basic features of the insurance customer portal

The vital capabilities of an insurance portal for customers include:

- Policy purchase. This section offers people a variety of policies, among which they can choose the one that suits their situation.

- Claim submission. Here, customers can file a claim in a no-sweat and uncomplicated way once an insurance case occurs.

- Document management. Portal users will find all the information related to their policy here. Naturally, they should be able to share, download, and print such documents.

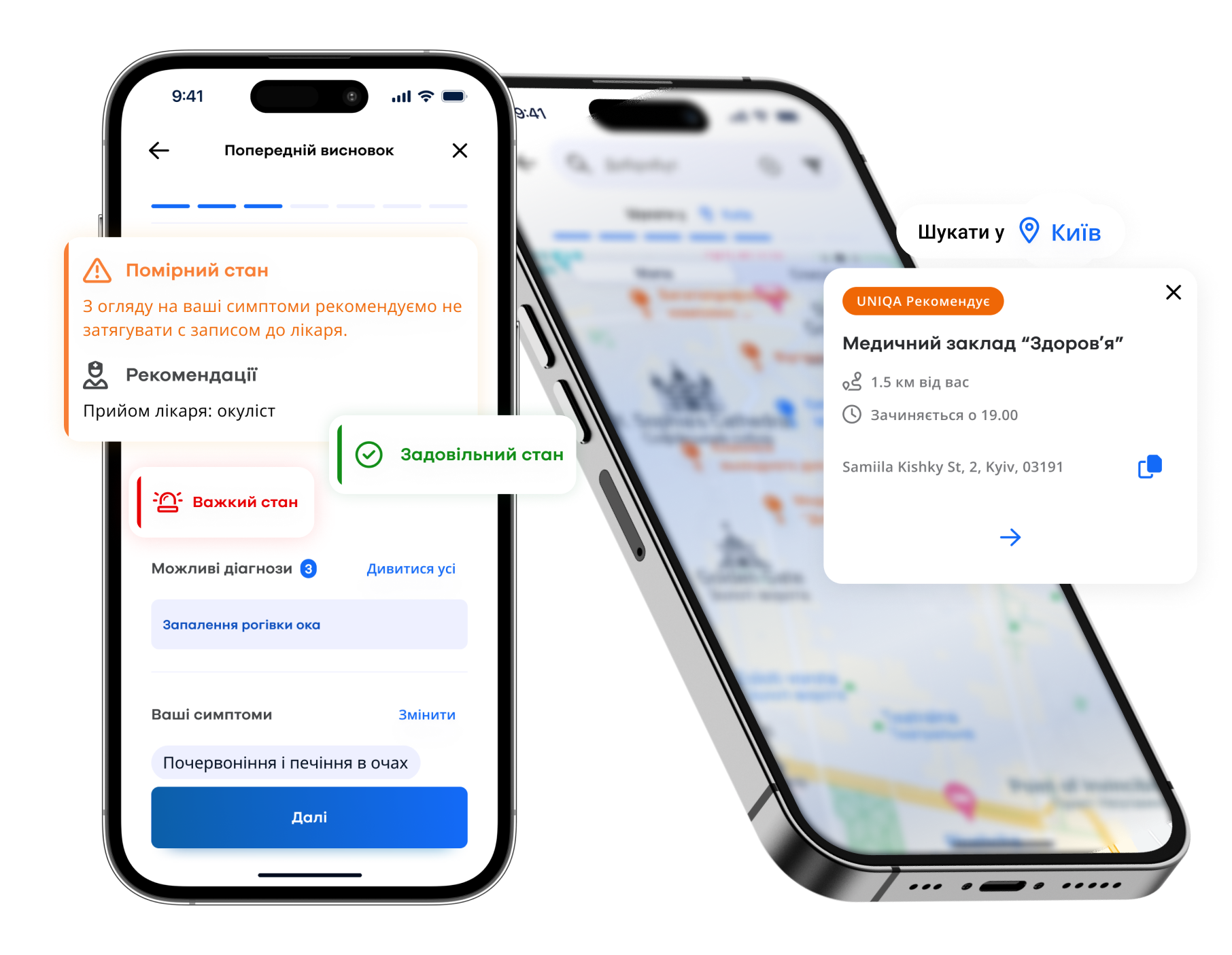

- Access to self-services. This capability allows people to apply for some routine procedure or service without consulting an agent or support team in such use cases as damage estimation, scheduling an appointment with a doctor, etc.

- Access to FAQ section. A vast majority of insurance-related questions are boilerplate ones, the answers to which people can find in this module.

Basic features of the insurance agent portal

Garden-variety insurance broker portal software should contain the following modules:

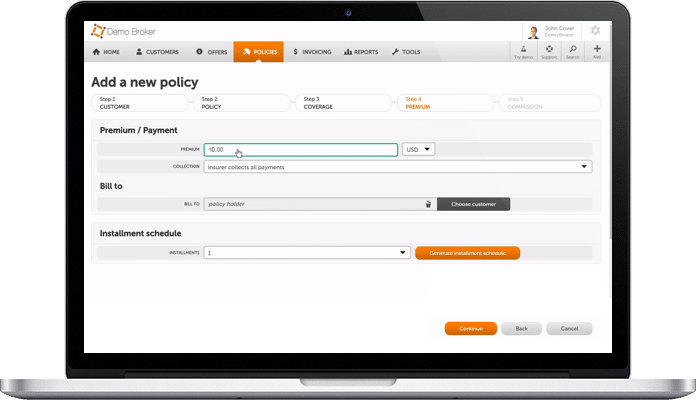

- Underwriting and risk management. Here, agents analyze insurance applications, evaluate related risks, and assess the coverage these risks will entail.

- Policy selling, cross-selling, and upselling. This item allows insurance suppliers to sell potential clients standard policies, offer them to upgrade their existing contracts with additional coverage and suggest acquiring other types of policies.

- Document management. Insurance personnel can create, store, retrieve, and handle all necessary documents (policy templates, claims, invoices, and more).

- Claim management. The entire procedure of claim processing, from verifying their eligibility to generating transaction reports and payment allocation, is performed in this section.

- Analytics and reporting. The functionality enables the collection, categorization, and utilization of transaction data as well as reserves tracking and calculations, BI analytics, regulatory reporting, payment settlements, etc.

- Marketing campaigns. This feature allows agents to review customer needs, monitor crucial marketing indices, and track sales, with the subsequent use of such data as insights for creating engaging campaigns aimed at driving policy sales.

Our services and solutions

Discuss functionalities you need

Book a callWant to discuss your project?

Contact usBenefits of custom insurance portals

Easy data access

Pipeline optimization

Streamlined claim submission and approval process

Customer analytics

Round-the-clock support

Fully customized features

About DICEUS

Why choose DICEUS?

Our development process

The SDLC we adhere to is based on the Agile methodology. In it, the portal development routine is broken into several dynamic steps (known as sprints), each consisting of planning, implementation, and evaluation. On completion of a sprint, we look back at what has been done, assess the outcome, and pinpoint areas for improvement to modify the next steps. Such a flexible technique ushers in the utmost adaptability of the development process, vibrant communication between team members, improved quality of IT products, and risk minimization, which all come together to guarantee a high level of customer satisfaction.

Discovery phase

Architecture and design

Development

Testing and QA

Deployment

Maintenance

Technology stack

Our achievements

Client reviews

Case studies

FAQ

What are insurance portal software development services?

These are the services a software vendor provides for insurance companies to develop a comprehensive online platform they can leverage in their workflow. Typically, such services cover the creation of a custom portal solution with organization-facing and customer-facing dashboards, its integration with the company’s existing IT ecosystem, the migration of the current legacy platform to a modern environment accompanied by its fundamental modernization, and more.

What is the importance of having a customized insurance portal?

Boxed insurtech products available in the IT market are made to fit a garden variety of a company. However, each player in the niche has its own organization size and structure, roster of services, target audience, business goals, etc. By opting for a bespoke insurance portal, you are sure to obtain a unique solution that will completely satisfy your requirements and dovetail into the business strategy your firm relies on in its activity.

How do you ensure the security of sensitive data within the insurance portal?

The main goal of data protection measures is to limit access to the information on the insurance portal, allowing only authorized personnel to handle it. This aim can be achieved via perpetual tracking of compliance with data privacy regulations, implementing robust data encryption (both at rest and in transit), instituting access control, organizing a reliable data backup and recovery policy, and establishing a stringent monitoring system. Also, insurance portal owners should conduct regular vulnerability scans and penetration tests of their products to minimize data burglary and leakage threats.

Can the insurance portal be accessed on mobile devices?

Nowadays, smartphones are the major device type used by people to work, study, shop, and have fun online. The same is true about getting insurance services. That is why competent IT vendors prioritize the mobile experience of clients and design insurance portals with an eye to their seamless performance irrespective of the channel and gadget customers leverage to access them.