Data analytics in insurance industry relates to the practice of collecting, storing, extraction, and processing relevant information of various kinds obtained from multiple sources. Given the vast amount of such dossiers and records in our digitalized world, the efficient handling of business and personal data can be implemented only via leveraging robust insurance data analytics software as a special kind of insurtech solutions. It will enable players in the domain to draw meaningful insights that can be utilized in optimizing their workflow and providing a higher level of customer satisfaction for their clientele.

Benefits of custom insurance data analytics software

The implementation of a first-rate analytics solution and its integrations with other elements of an organization’s IT ecosystem usher in weighty boons for upgrading the major workflows of an insurance company.

Customer insights and personalization

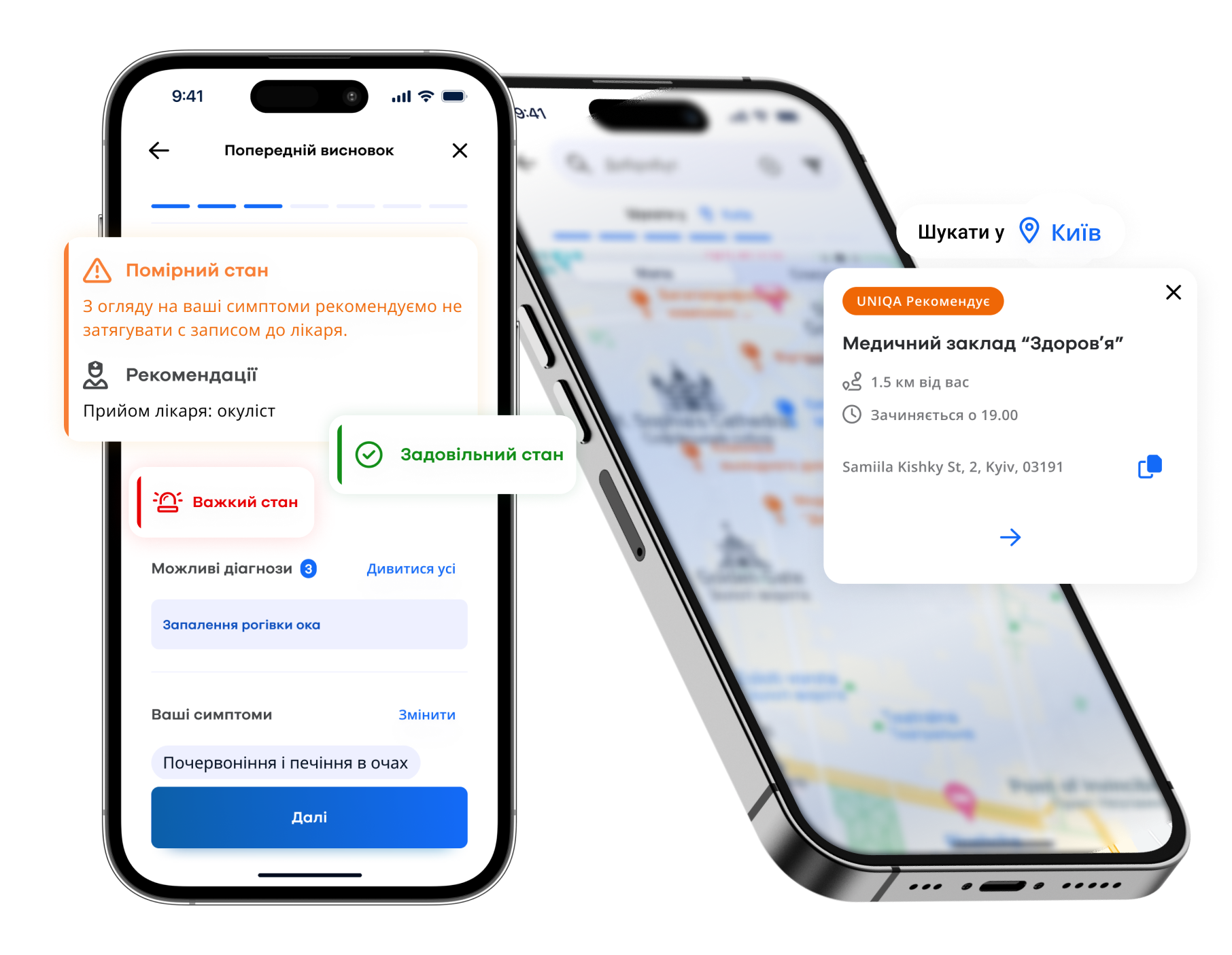

By collecting and properly analyzing demographic, behavioral, and other information about clientele, insurance companies form a 360-degree view of their customers. Having such individual profiles at their fingertips, they can personalize their marketing efforts and suggest individually tailored services, discounts, offers, etc.

Enhanced operational efficiency

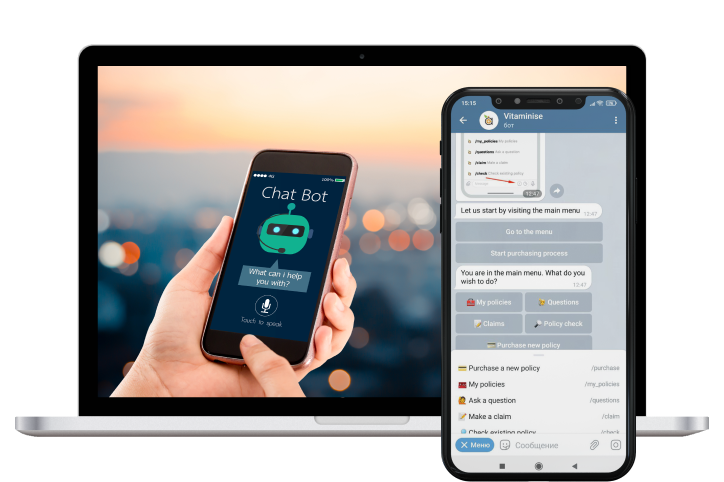

The outcome of data analysis allows insurance companies to streamline and facilitate their shop floor routine, identify and forestall risks, boost decision-making, and increase the productivity of employees.

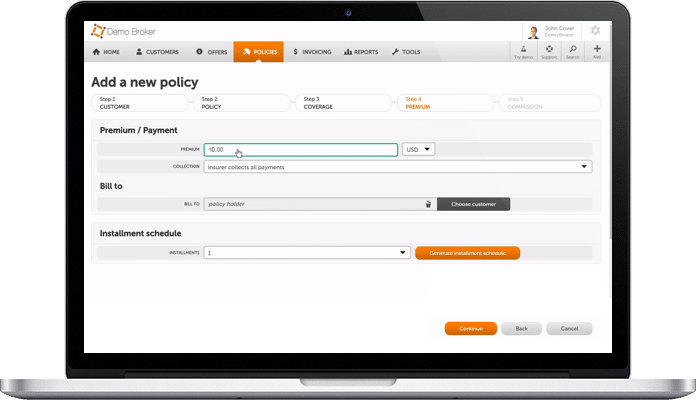

Improved pricing strategy

In-depth product profitability analysis, conversion ratio, retention ratio, and other indices are keys to revising an insurance organization’s existing pricing policy and modifying its underperforming elements.

Claims processing automation

Data analytics software drastically accelerates the entire lifecycle of handling claims (from the notice of loss through damage assessment to payment processing), pinpoints suspicious claims, helps minimize fraud and prevents litigation.

Get a free consultation on data analytics for insurance

DICEUS approach to building data analytics for insurance

In numerous successful insurance data analytics projects DICEUS has delivered for insurance companies, we prioritized three mission-critical aspects of such an analytics platform.

Raw data

As it happens in any business intelligence initiative, big data analytics in insurance begins with accumulating unprocessed and unformatted data. Its analysis can’t be effective unless it is knocked into shape, which makes it eligible for further handling by analytical tools. That is why it should be cleaned, organized, and transformed before insurance analytics software comes into play.

Algorithms

These are the methods of discovering the best ways of turning raw data into insights insurance companies can employ for performance optimization.

Visualization

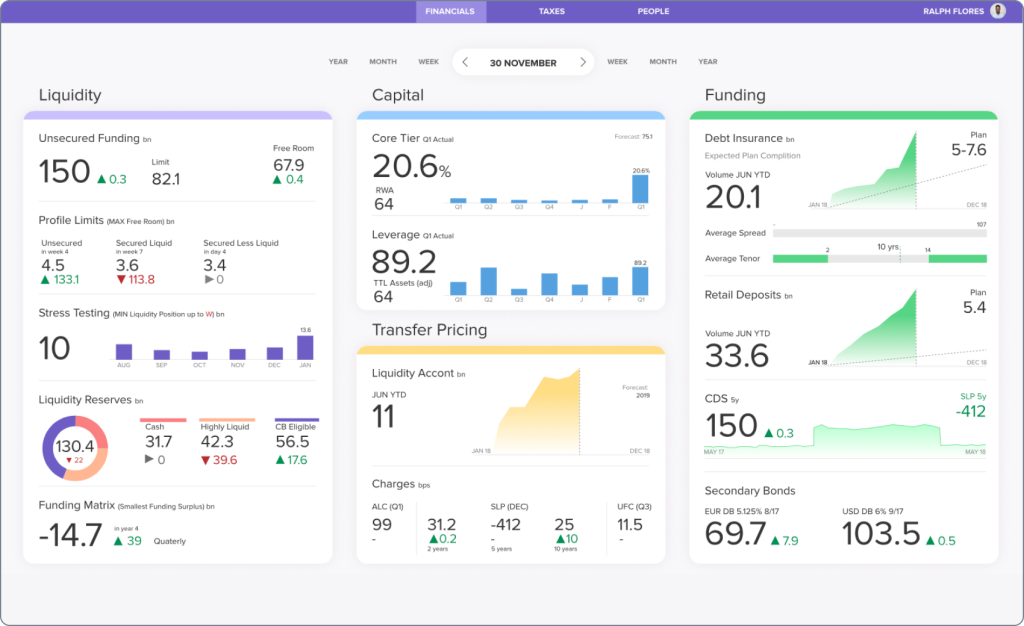

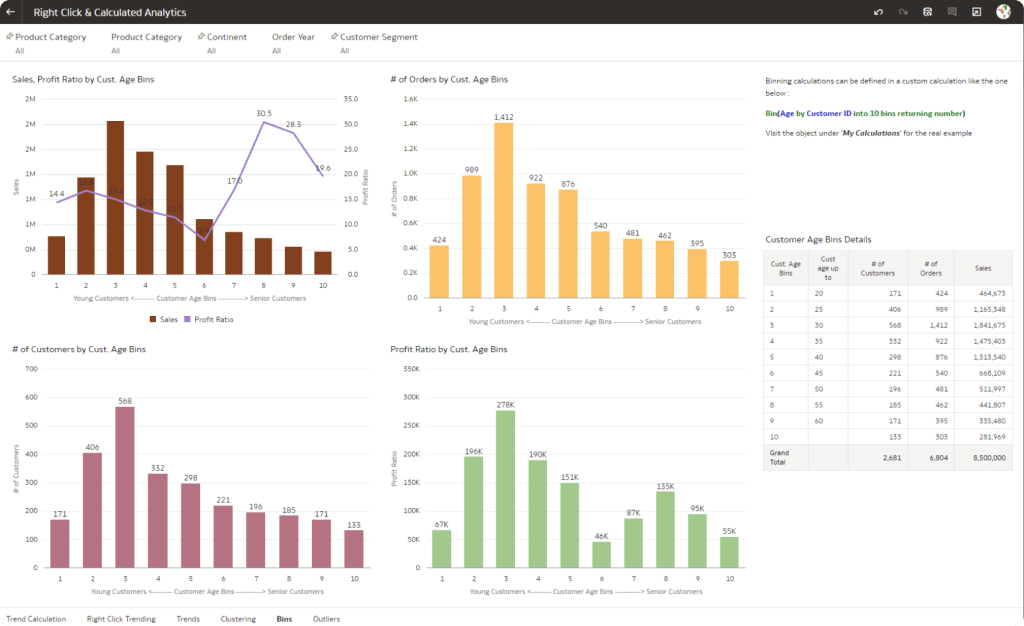

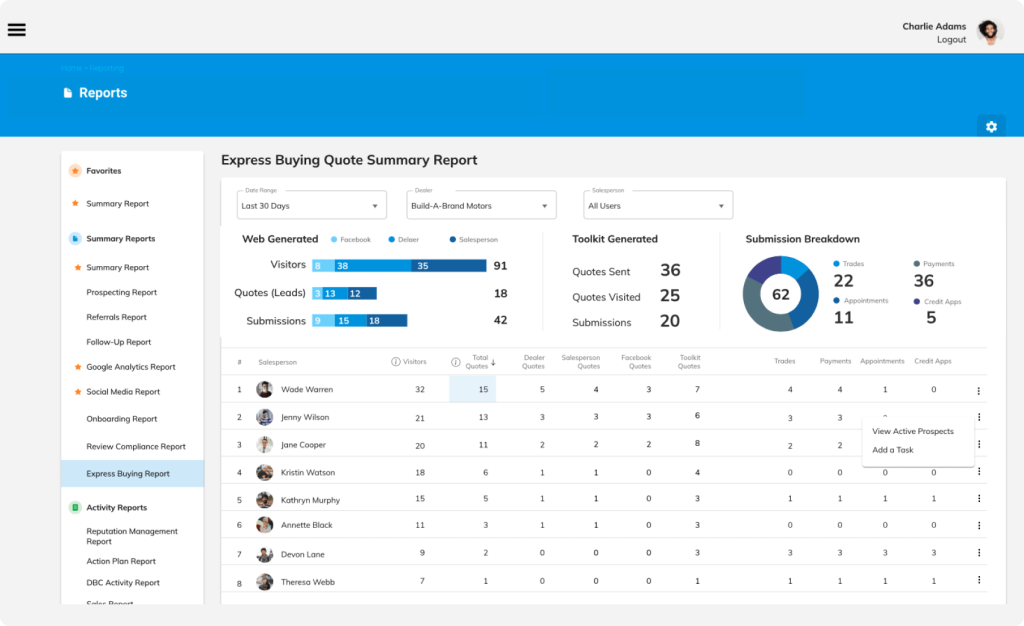

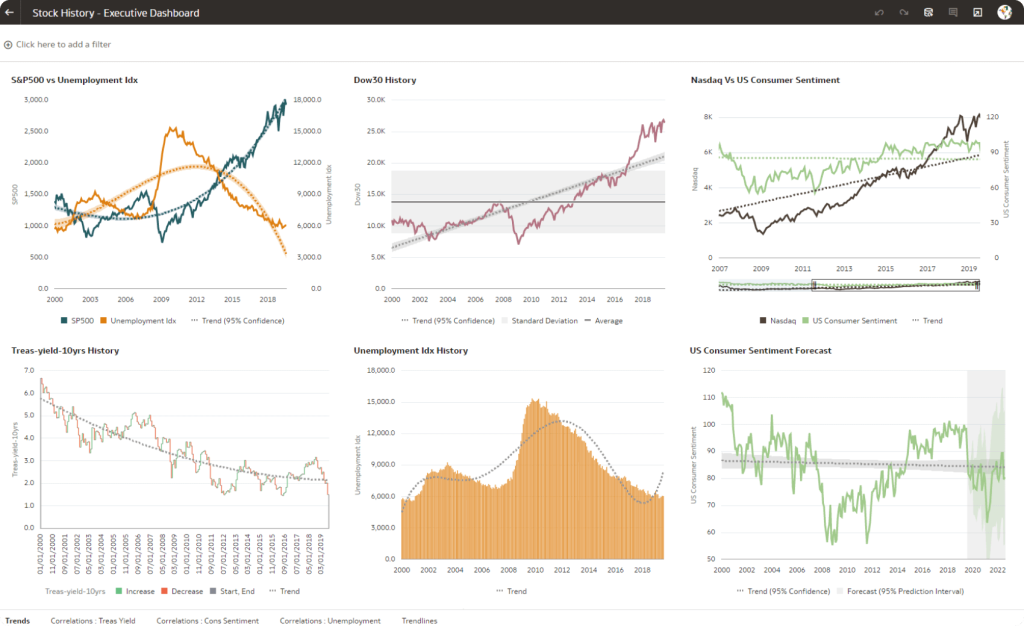

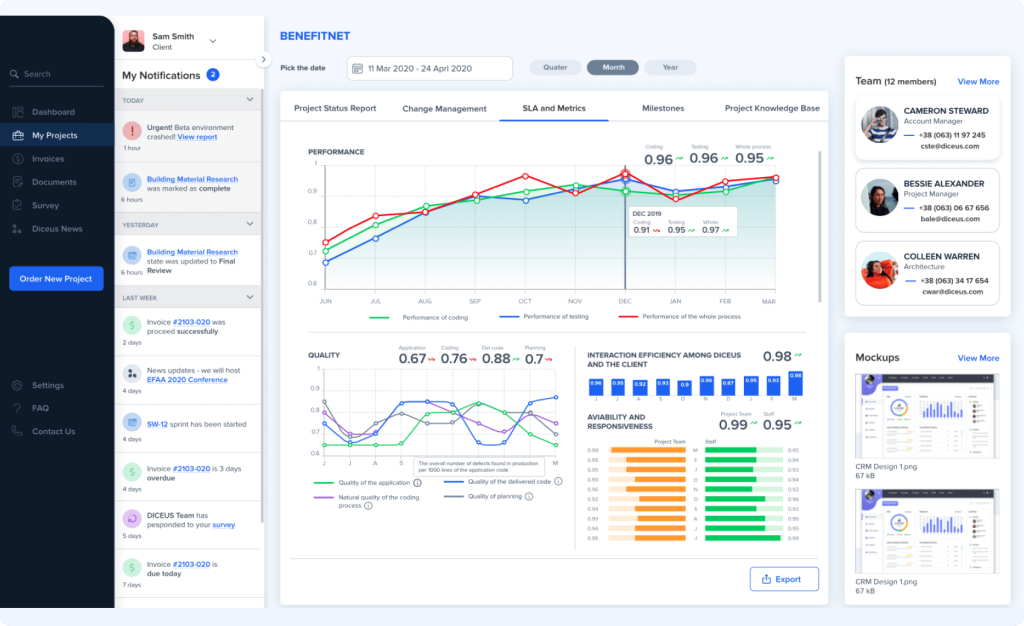

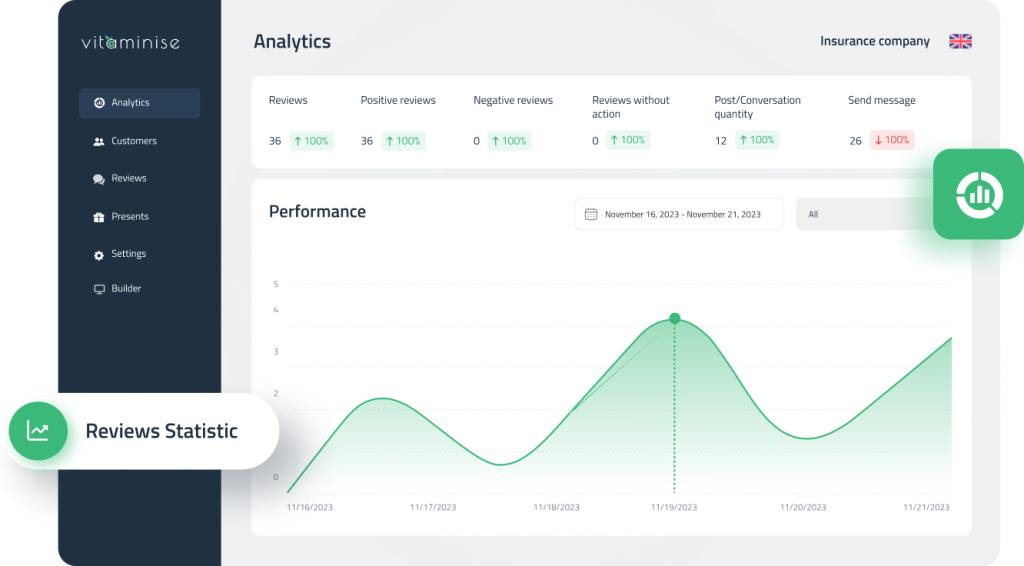

The efficiency of data analytics software for insurance agency or company is essentially conditioned by a straightforward and easy-to-understand representation of data processing results. Static, dynamic, and interactive visual features and tools enable personnel working with the solution to come to grips with complex qualitative and quantitative indices displayed in a comprehensible graphic form.

Example dashboards

About DICEUS

Our achievements

Our partners

Insurance data analytics pipeline

A data analytics routine is established for each particular case depending on the customer’s needs. However, the typical procedure of setting up an efficient data analytics pipeline for an insurance company covers the following steps.

The type of analytics you will opt for depends on the nature of the data it will be leveraged to process. A more elaborate scrutiny may necessitate utilizing diagnostic, predictive, or prescriptive methods, but descriptive analysis will suffice for a simple overview of data.

Client reviews

Our case studies

FAQ

What are insurance data analytics software development services?

IT vendors offer various services related to creating and implementing data analytics software for insurance agencies. Here belong the development of a standalone custom analytics solution or an embedded module from scratch, customization and integration of third-party analytics software with the existing infrastructure, migration of the analytics product, modernization of a legacy solution, etc.

How does insurance data analytics software development work?

It starts with the discovery phase when the vendor learns the project requirements, scope, budget, and timeframe. All these factors condition the choice of the underlying software architecture and data processing model (ETL, ELT, or ETLT). Then comes the implementation of the model during the development stage, testing the finished solution, and its deployment for further use. Solid vendors also include support and maintenance services in the deal.

What are the benefits of using custom insurance data analytics software development services?

By commissioning a bespoke insurance data analytics solution, you will obtain a unique product that will be honed to meet your organization’s requirements and dovetail into your company’s business goals. Leveraging it, you can step up your pipeline efficiency, improve your pricing strategy, obtain meaningful insights into customer behavior, and guarantee maximum customer satisfaction for your clientele.