Key value propositions

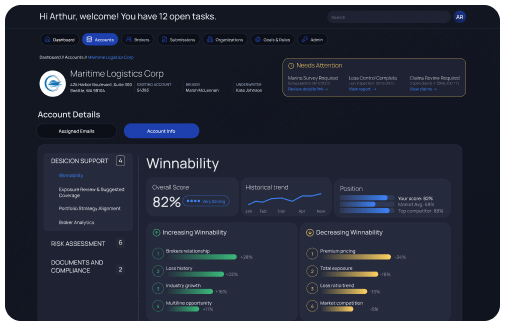

AI-driven intelligent decision support

AI-driven intelligent decision support

Embedded AI capabilities analyze unstructured data, evaluate risk, identify anomalies, and surface decision-ready insights in real time. Underwriters get contextual recommendations to enhance risk selection, pricing accuracy, and overall underwriting quality.

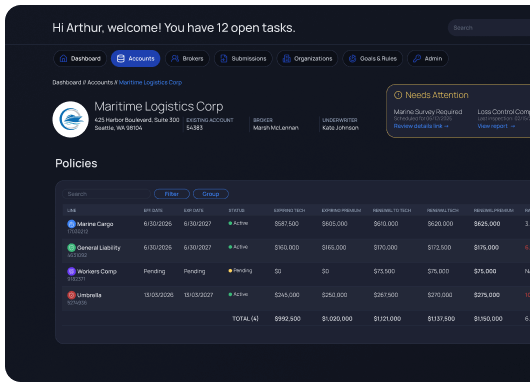

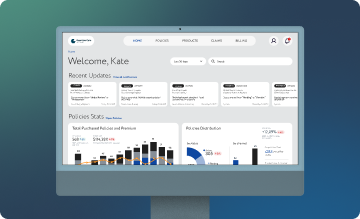

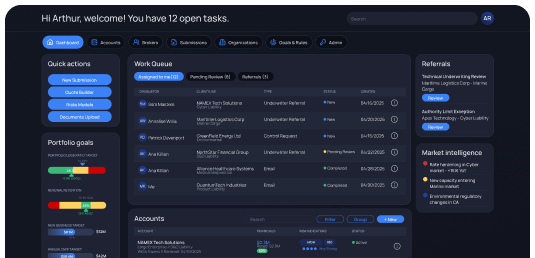

Centralized workflow management

Centralized workflow management

Handle every step of the underwriting journey from a single pane of glass. Our configurable workflows offer complete visibility into submissions, quotes, policies, and tasks—ensuring nothing slips through the cracks.

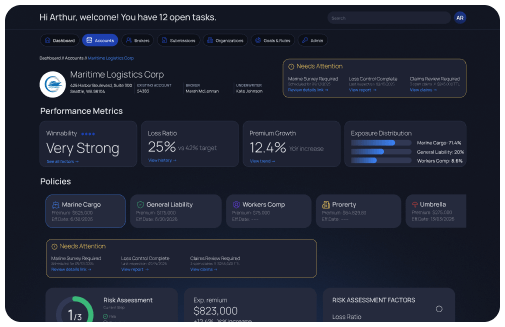

Account-centric 360° customer view

Account-centric 360° customer view

Move beyond submissions. Get a holistic understanding of your accounts with access to full policy history, claims data, broker relationships, and current exposure. Make strategic decisions with a complete picture of the customer.

Rate, price & quote automation (RPQ)

Rate, price & quote automation (RPQ)

Speed up the quote process with AI-assisted pricing models and pre-configured business rules. Decrease manual work and inconsistencies while enhancing quote turnaround time.

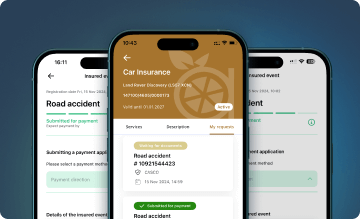

Delegated authority & broker portal

Delegated authority & broker portal

Support your distribution ecosystem with a unified portal for brokers and coverholders. Whether working with traditional brokers or managing general agents (MGAs) under delegated authority, the platform offers secure submissions, real-time collaboration, and access-level control tailored to each partner's role.

Clash check & risk overlap detection

Clash check & risk overlap detection

Lessen portfolio risks with built-in tools that detect policy overlaps, conflicting coverages, and accumulations in real time. Protect your book and improve underwriting control.

AI-powered submission intake

AI-powered submission intake

Ingest unstructured submissions from email and documents leveraging natural language processing. Convert messy attachments into structured, actionable data.

Clause & wording library

Clause & wording library

Standardize policy language and maintain contract certainty with an intelligent clause library. Ensure regulatory compliance and accelerate document generation.

Seamless external integrations

Seamless external integrations

Connect effortlessly to risk data providers, bordereaux processors, asset valuation sources, and more. Open APIs allow you to work within your ecosystem without disrupting core workflows.