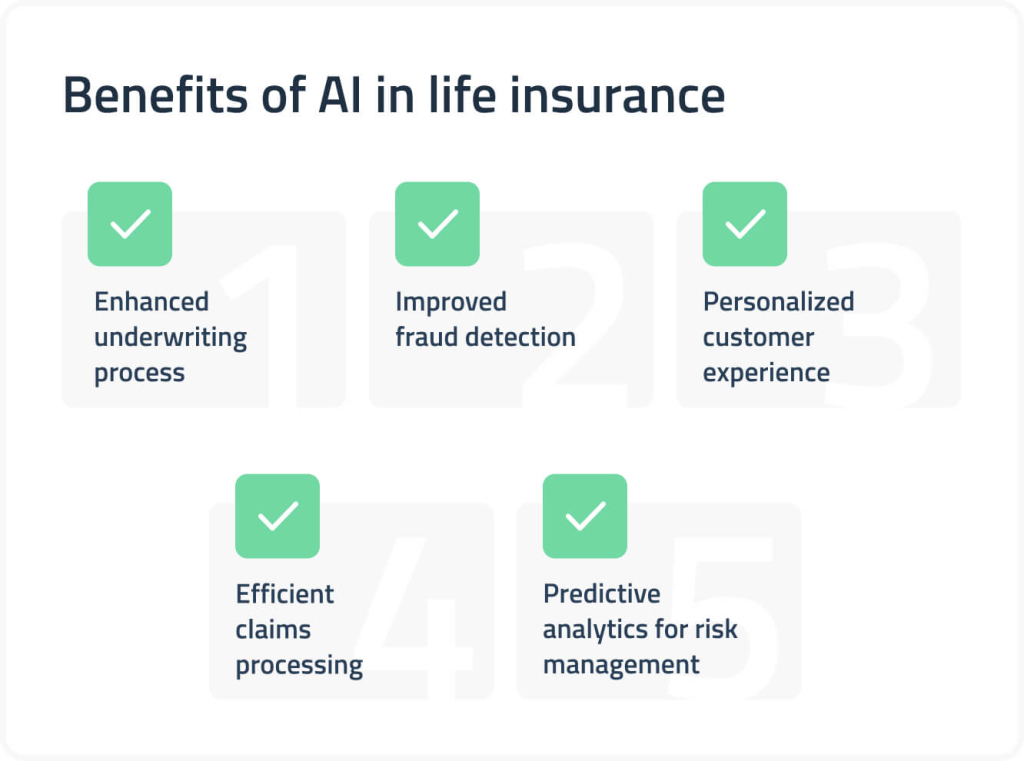

Benefits of artificial intelligence in life insurance

For life insurers, AI’s impact is far-reaching, influencing everything from risk assessment and product recommendations to customer service. For instance, machine learning models can sift through historical data to assess a customer’s risky behavior, improving the accuracy of risk management and underwriting processes. AI-powered systems can flag fraudulent claims in real-time, reducing operational costs and minimizing financial losses.

AI technology has the potential to completely reshape how the life insurance industry operates by leveraging massive amounts of data to create smarter, more efficient processes. In the long run, it gives all the opportunities to make life insurance more accessible and affordable for customers worldwide.

Read a related article:

Artificial intelligence in health insurance: Main advantages

Enhanced underwriting process

The old underwriting process in life insurance was slow, manual, and often error-prone. However, AI has dramatically improved essential underwriting processes through automation. For example, AI systems use big data and machine learning techniques to assess applicants’ health risks more quickly and accurately than humans. This means faster decisions that cut the time customers have to wait for coverage.

Custom-created underwriting models can analyze individual health records, lifestyle data, and other personal factors to calculate risk more precisely, enabling insurers to offer tailored premiums and coverage plans.

Need to improve underwriting processes?

Learn more about our underwriting software development services.

Improved fraud detection

AI systems can analyze patterns in claims data, spotting fraudulent claims that might be overlooked by human agents. By integrating machine learning algorithms, insurers can continuously improve their fraud detection capabilities, flagging suspicious activity with greater accuracy. Fraud detection is something that needs to be prioritized in any insurance claims-related processes, and AI helps reinforce it inside out.

As a pro tip, in practice, you can also implement generative AI to simulate potential fraud scenarios. Thus, an insurer gets to stay ahead of evolving fraud techniques in the insurance business.

Personalized customer experience

AI enables life insurers to deliver more personalized services by predicting customer needs. Smart tech, like natural language processing (NLP), allows integrated AI models to easily handle routine customer inquiries, taking the load off your human insurance agents as well.

For instance, AI chatbots can assist customers in selecting policies based on their unique needs, and AI-driven recommendation systems can suggest insurance products that match customer profiles.

Efficient claims processing

Automating the claims process with AI significantly speeds up claims settlement, granting faster payouts for customers. AI systems can validate claims, cross-check data, and process payments with minimal human intervention, all while reducing errors due to AI’s mighty preciseness capacities.

Here’s a pro tip: Mind the computer vision technology, which you can leverage to analyze accident or medical images, making your claims assessment process even more automated and heavily regulated.

Predictive analytics for risk management

AI is excellent at crunching large volumes of data to provide predictive insights. In the life insurance industry, AI can predict potential risks based on past claims data, helping insurers optimize their risk models. With a good eye on high-risk customers identified early on, companies can customize their premium rates and adjust policies accordingly.

You might be interested in reading our latest article:

List of top insurance software to use in 2025

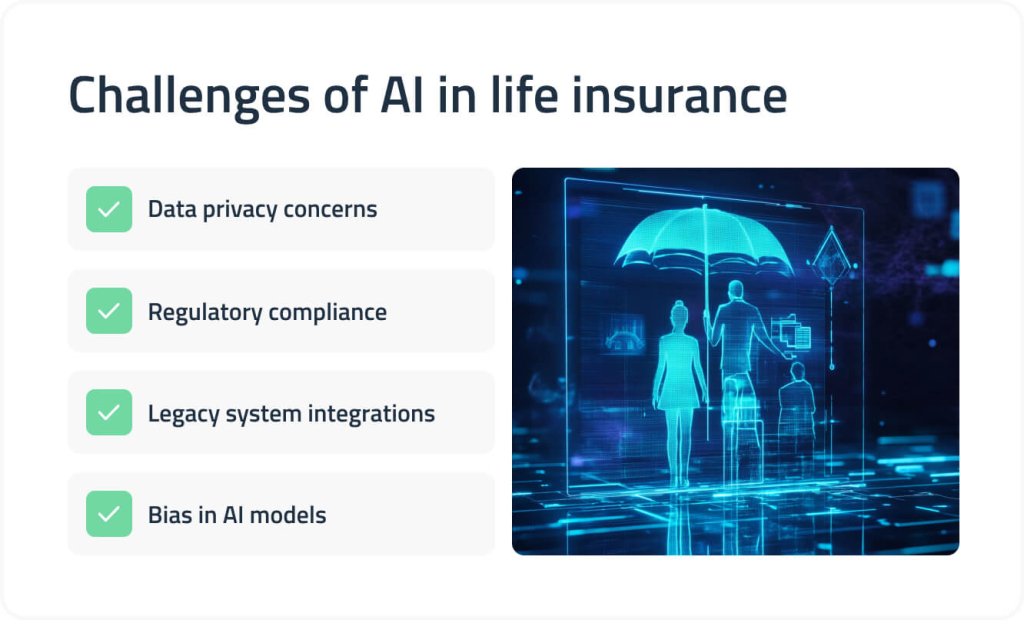

Challenges of implementing artificial intelligence in life insurance

AI powers and improves life insurance processes in many ways, but not without its drawbacks still. We must keep in mind that, however available and accessible today, AI is a complex technology that requires skill and technical capacity to implement or integrate (let alone train and configure new models).

Here are the main challenges you might face when leveraging AI in life insurance.

Data privacy concerns

As insurers accumulate and leverage more data to improve their AI models, they must navigate privacy regulations to protect customer information. The use of sensitive data like medical records can raise compliance issues with state insurance regulators. Continuous privacy measures and transparent customer communication are necessary to keep all private things protected for all parties.

Regulatory compliance

AI-driven decisions in underwriting or claims processing must comply with existing insurance regulations. Regulative bodies are scrutinizing AI technologies to ensure they operate fairly and ethically. State insurance regulators are forming working groups to create frameworks that address AI implementation while maintaining industry standards.

Legacy system integrations

A well-established life insurance provider may still run things on an out-of-date, legacy system. It can be quite problematic to make it work with newly integrated AI technologies (and integrate them in the first place). This is why you must be ready to either refactor or replace outdated systems, watching your running operations (if any). Transitioning to AI-driven processes can also involve a steep learning curve for employees, requiring specialized training.

Bias in AI models

AI systems can inadvertently introduce bias into insurance decisions if the underlying AI models are not trained on diverse datasets. For example, a smart system trained on biased data could make AI unfair in its rating of certain demographic groups as higher-risk customer segments. Model training, curation, and testing must be as scrupulous as possible, using the highest quality of data available.

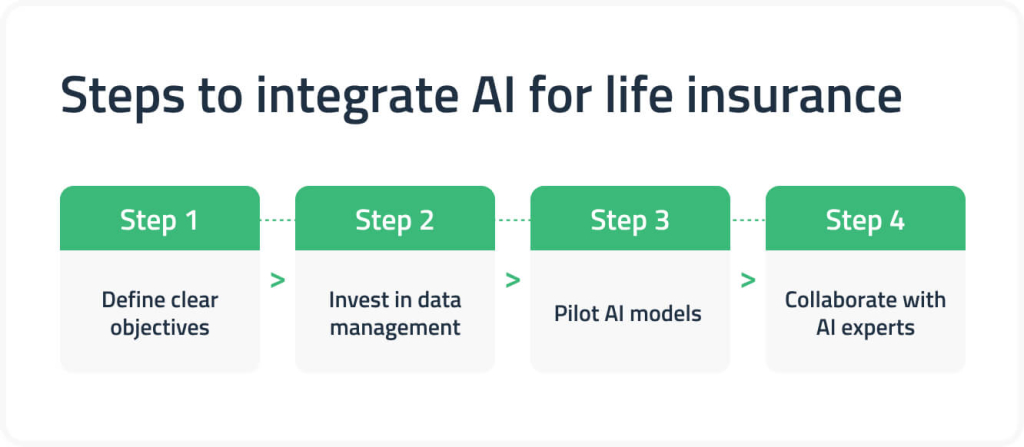

Key steps to integrate AI for life insurance

The process of AI integration in life insurance can vary a lot from project to project, depending on the scope of needs, workflow specifics, technological complexity, etc. To achieve the most reliable structure, a life insurance agency leveraging AI should take things step by step as follows.

Step 1 – Define clear objectives

Before implementing AI, insurance providers must define the specific objectives they wish to accomplish, such as improving underwriting, reducing fraud, or enhancing customer experience. Clear goals help guide the development and integration of AI systems to address specific needs in the life insurance sector and deliver the most useful and ROI-intensive solutions.

Step 2 – Invest in data management

AI models rely on intense flows of data in order to perform up to their function. This is why you need a specialized, robust place to store, organize, and analyze all the data that accumulates and gets prepared for AI’s training consumption. You need high-quality data, meaning clean, well-structured subsets of readable data without bias. This paves the way for valuable insights and accurate predictions.

Step 3 – Pilot AI models

Before going for full-scale AI model implementation, an insurance company can simulate various circumstances and outcomes by running pilot programs. You can see how the newly shaped AI acts in a controlled environment.

Pro tip: Start piloting customer scenarios in one area, such as claims management, to minimize disruption and gain valuable insights before expanding AI across other areas of operations.

Step 4 – Collaborate with AI experts

AI is everywhere these days, but knowledgeable, reliable professionals specializing in its variety of implementations can be quite scarce. It’s best to turn to well-tried service providers with flexible collaborative conditions. With DICEUS, for example, you gain extensive expertise and multi-faceted assistance with the integration, modification, and optimization of AI models in line with your insurance operations.

Estimate project costs

Please share more details of your project with our team.

DICEUS expertise

At DICEUS, we specialize in delivering AI-powered solutions tailored for the insurance industry on all sides. We do AI applications for underwriting, fraud detection, claims management, and risk assessment. We work closely with insurance companies to identify their unique needs, design AI solutions, and implement them in ways that match both global regulatory requirements and particular business objectives.

Contact us to discuss your vision and needs, come up with a project outlook, and launch an AI integration project that will boost your company.

FAQ

How is artificial intelligence used in life insurance?

There is a huge scope of application for AI in life insurance. It is used for automating underwriting, streamlining claims processing, detecting fraud, and improving risk management. It can also help insurers personalize customer interactions and recommend products tailored to individual needs.

Will AI replace life insurance agents?

AI has become pretty good at handling routine tasks, like claim processing and Q&As. However, it is very unlikely to replace human agents fully. Instead, AI will augment their roles, allowing agents to focus on more complex customer inquiries and advisory services.

How is AI implemented in insurance?

AI is mostly implemented through the integration of machine learning models, auxiliary technologies like NLP, and automation tools into core insurance functions such as underwriting, claims management, and fraud detection.

Does AI play a pivotal role in the life insurance sector?

Yes, AI plays a crucial role in transforming the life insurance sector by automating processes, improving accuracy in risk assessment, and enhancing customer experiences. It is gradually turning into a competitive necessity rather than an extra addition to a sufficient workflow.