Banking software development expertise

Banks, superbanks, and digital banking solutions require sturdy custom software capable of supporting and driving the success of finance, data, and security-tuned infrastructures. The full range of banking software development services that we deliver at DICEUS encompasses all the expertise, know-how, tools, and technologies to cover every angle of your banking software project.

DICEUS banking industry software specialists are ready to take on the planning and design, development and deployment, optimization and improvement, and launch and promotion of your software product. We build innovative solutions to power market-defining apps and platforms, be it a mobile app dedicated to your bank or a full-blown multiplatform superbank — a fully digital, personalized banking infrastructure.

Here’s what we do:

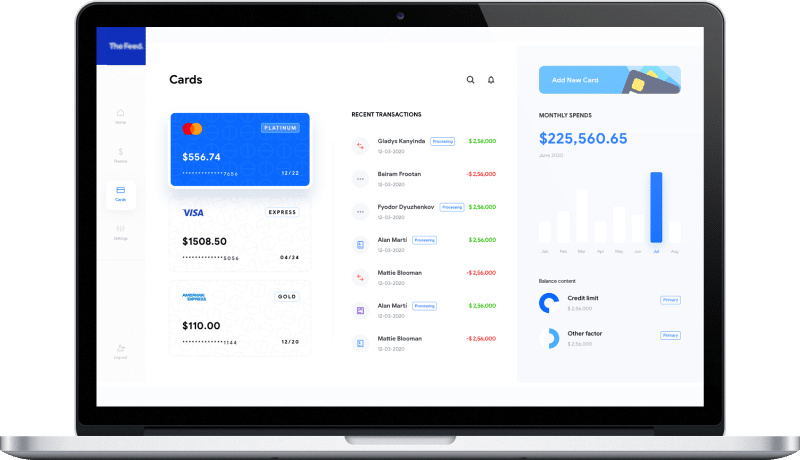

Online banking

We are a financial software development company with twelve years of expertise in developing online banking systems encompassing a whole package of functionalities from scratch. If there is a need to upgrade the existing web banking, we are also at your disposal.

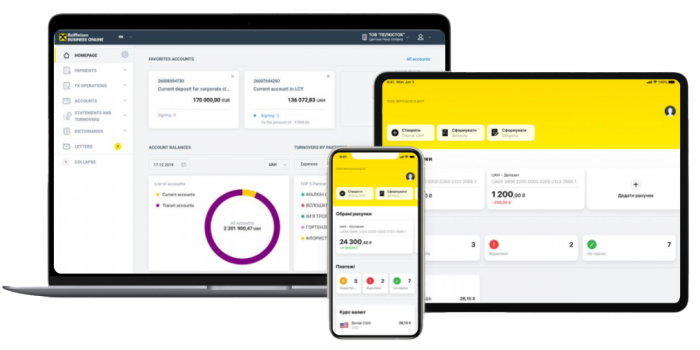

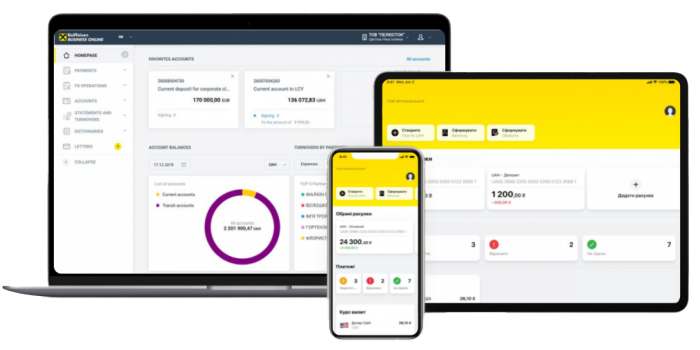

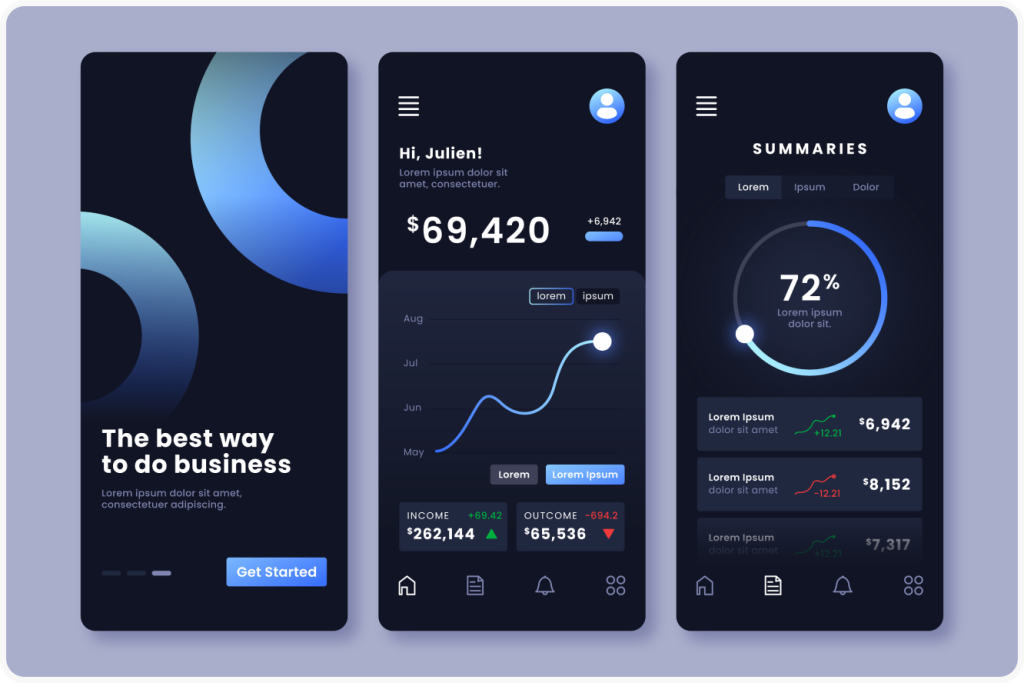

Mobile banking

We build mobile banking solutions with a number and variety of functionalities required by your needs and processes. The basic features include account management, payments, money transfer, notifications, GPS, and personal financial management.

Learn moreCore banking systems

Our teams deliver projects associated with such core banking platforms as Oracle FLEXCUBE, Temenos, and Finastra. The range of our services for core banking consists of custom engineering, system or module upgrades, software audit, technical support, testing, and IT consulting.

Learn moreDWH for banking

A centralized DWH can cover a lot of gaps related to data that exists in banks and make all your data organized and structured. Our teams have experience in DWH architecture, ETL processes, data aggregation, data migration, maintenance of databases, and legacy applications decommissioning.

Learn moreRobotic process automation

We provide RPA integration to help banks improve their adherence to regulations, risk management, and customer experience and make operations more efficient.

Our expertise includes RPA solutions for risk management, compliance, AML, fraud inspections, and customer support.

AI development for banking

AI-based solutions can help banks resolve some of the pervasive difficulties related to customer experience, decisioning, and forecasting. We are a banking software development company that develops AI-powered systems that provide a 360-degree view of banks’ customers, their behavior, and historical data.

Learn moreWe help banks rationalize their processes to increase profitability using the power of technology and by providing our financial software development services. In today’s reality of the fast-changing global economy, banks must be prepared to tackle the issues related to efficiency, customer experience, and compliance. Therefore, you can upgrade your outdated systems, eliminate technical debt, and improve data management. DICEUS’ banking software development expertise includes core banking systems, data warehouses, cloud computing, cybersecurity, robotic process automation, etc.

Challenges with financial services software?

Apply for a professional consultation!

Some interesting statistics

Challenges we help banks overcome with our services

Time-to-market

Fast software development lifecycles with a guaranteed quality of execution. We know how to build custom solutions to serve as the backbone for banks, digital banking service providers, and financial institutions requiring faster, more connected performance. And we build them fast, based on well-polished methodologies.

Authenticity

Seasoned specialists bring their experience and proven expertise to your project. We are well aware of all the latest market trends and financial sector requirements, offering unique expertise-driven perspectives on how your project lifecycle can unfold in the most long-term efficient way possible.

Marketing and impact

Helping to launch, promote, and market new banking solutions with a bang. We share methods and implement aspects that help achieve active customer engagement organically through inviting design and technology expertise put at the core of user the top-notch experience.

Cost-efficiency

Achieving convenient project conditions and software solutions that stay in line with your budget through well-tried technology, experience, and individual approach. We personalize technology stacks and tailor projects to your existing capacities, helping to battle hidden costs and unnecessary extra features.

Key advantages of choosing DICEUS for financial custom software development

About DICEUS

How we work

At DICEUS, we offer building banking and financial solutions according to a well-organized SDLC. Here’s how it works.

Get professional financial software development services!

Explore our case studies

Testimonials

Our tech stack for financial software development services

Frequently asked questions

What software is mainly used in banks?

We develop all types of software products used in banks and other financial institutions. Our banking software development services include core systems, mobile apps, web solutions, data warehouses, RPA, and AI technologies implementation. We also provide engineering services for implementing platform-based solutions like Oracle, for instance.

How do you ensure that users’ data is secure?

We apply the latest security technologies to adhere to the current cybersecurity standards. To check how software complies with regulations, we use penetration testing. Together with our customers, we discuss cybersecurity challenges and requirements before the project starts.

Do you use the latest technology?

We use the latest tools to create products that can compete with modern fintech solutions. Our finance software development company continuously improves its skills and knowledge by visiting various workshops and conferences devoted to software development for financial services. This allows our engineers to stay aware of the cutting-edge technology trends adopted by modern banks, fintech companies, and other organizations.