Fintech software development expertise

Fintech software development services allow up-to-date finance-related providers, like banks, insurance agencies, and investment firms, to acquire customized digital solutions and take performance, productivity, and sales to the next level of quality and speed.

Agencies and providers across any industry, including healthcare and education, can tap into innovative software solutions for seamless payments, P2P transactions, and data analysis.

Furthermore, startups and idea-driven entrepreneurs can order individual services, developing any required features and capacities for unique fintech solutions.

DICEUS is your one-stop, full-cycle fintech software development company of choice, where qualified specialists with a proven track record are ready to take on the creation of desktop, web, and mobile banking solutions of any scope and purpose. Here’s what we do:

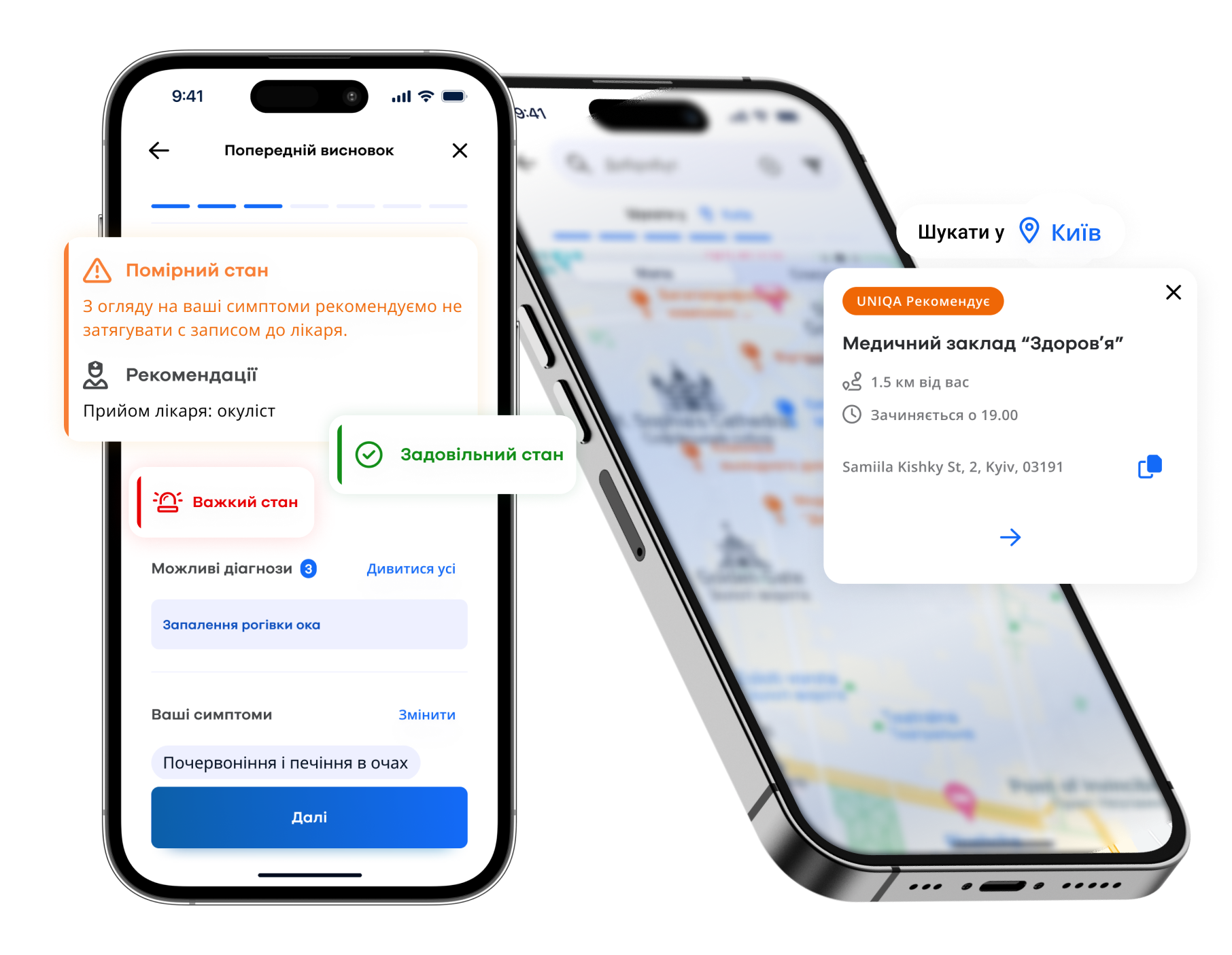

Fintech apps

Enrich your financial services with a modern and secure fintech app powered by the latest technologies. We build mobile banking app, payment applications, finance management apps, blockchain-fueled software with an in-depth understanding of your business.

Learn morePayments

Use professional fintech development services to develop a custom payment gateway or a peer-to-peer solution for payments. We offer both custom development and configuration of ready-made gateways to meet your needs and business goals.

Learn moreLending

We offer end-to-end custom development, modernization, and integration of loan management software solutions for financial organizations and banks. All solutions are produced to help our clients gain efficiency in their operations and reduce costs.

Learn moreMoney transfers

Implement cloud-based software for money transfers that will give you a 360-degree view on customers, real-time and historical data monitoring, user-friendly dashboards, and a lot of opportunities to grow. We handle both custom development and ready-made customization projects.

Learn moreBlockchain

Our fintech software development company can help your financial organization build and offer to your clients advanced blockchain-based solutions for cost-effective payments and transfers, secure authorization, and better cybersecurity.

Learn moreRegulatory compliance

We help financial organizations better deal with compliance regulations with the help of technology. In case you have any pressing issues with compliance, our experts will identify the right technology solutions for you based on in-depth business analysis.

Learn moreAI and ML integration

Our advanced AI and machine learning solutions for in-depth, smart financial analysis help providers and financial institutions leverage data for predictive analytics, customer insights, and automated decision-making, keeping all finance data in one well-protected, accessible place.

Personal finance management

Analyzing closely the needs and desires of your end-users, we create tailored apps and tools for effective budget management, expense tracking, and financial planning, all designed to provide personalized financial insights and advice on the latest global market trends and shifts.

We help many of our customers better understand what challenges they can overcome by adopting fintech. The fintech ecosystem is growing rapidly and unites thousands of solutions for payments and transfers, lending and financing, insurance, financial management, markets, and exchanges. Our team has strong experience providing fintech software development services by implementing ready-made solutions and custom apps. We not only deliver innovative software products but also ensure professional tech advisory and support to manage changes to architecture that arise after implementation.

Get professional consultation on your fintech project!

Key advantages to choose DICEUS for fintech software development services

Our fintech development process

We have a well-defined development process for every type of software product. Each project starts with the initial phase, and goes on with requirements gathering and business analysis. Next, come design and development stages, testing, and deployment. On the closure phase, we hand over all the project documentation and source code to the client and offer further technical support and maintenance.

Which organizations gain from developing custom fintech software?

Custom fintech software development brings value to various industries and fields. The seasoned specialists at DICEUS have been providing services of all scopes and empowering clients like:

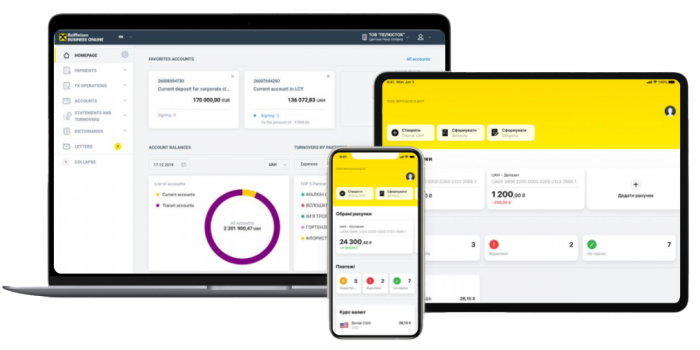

Banks and financial institutions

- Enhanced digital banking services and higher customer engagement can be achieved through custom mobile banking apps and customer-tuned online platforms;

- Advanced fintech solutions help banks manage credit risk, market risk, and operational risk more effectively through real-time financial data analysis and predictive modeling;

- Tailored compliance solutions help banks adhere to dynamically changing regulations, avoiding extra fines and legal complications.

Insurance companies

- Fintech software automates the claims process, reducing turnaround times and improving customer satisfaction through personalization and accessibility.

- AI-driven analytics can be leveraged to create fine-tuned personalized insurance offerings that meet the specific needs of individual clients.

- Implementing blockchain technology can enhance transparency and security in policy management and claims processing.

Fintech startups

- Customized fintech solutions empower innovative concepts and products that stand out in the market and efficiently solve the pains of whole user audiences.

Retail and e-commerce providers

- Custom-integrated payment gateways and digital wallets enhance the customer experience by providing secure, fast, and convenient payment options.

- Fintech solutions enable the creation of advanced loyalty programs that integrate with payment systems, driving customer retention and engagement.

- Buy Now, Pay Later (BNPL) services offer flexible financing options to customers, increasing sales and improving cash flow.

Investment firms and wealth management agencies

- Custom portfolio management tools allow for real-time tracking, analysis, and optimization of investment databases and portfolios, helping firms deliver better returns for their clients.

- AI-driven robo-advisors offer automated investment strategies and portfolio management, catering to a broader client base.

- Big data and analytics help analyze, plan out, and make investment decisions and offer clients tailored financial advice.

Healthcare providers

- AI-enabled systems can efficiently integrate with health insurance platforms for smart billing and claims processing.

- Fintech tools can offer patients flexible payment plans for medical expenses, improving healthcare service availability.

- We can implement secure, HIPAA-compliant payment processing systems for patient transactions.

Real estate agencies

- Custom fintech solutions enable real estate firms to offer digital mortgage services, property financing, and investment platforms.

- Blockchain technology facilitates and secures real estate transactions, granting next-level transparency and fending off fraud.

- Online rental payment solutions streamline rental payments and management for property owners and tenants.

About DICEUS

Explore our case studies

What our clients say

Frequently asked questions

What is fintech software, and why is it important?

Fintech software is the software built with the involvement of innovative technologies like artificial intelligence, machine learning, robotic process automation, blockchain, and a combination of some of these. Fintech is opening new opportunities to banks and financial organizations to increase customer satisfaction, improve efficiency, and reduce operational costs.

We help you get the maximum out of those opportunities, delivering top-of-the-line customized digital banking solutions for banks, agencies, and enterprises, smart payment gateways, personal finance management apps, online platforms, marketplaces, and exchanges, mobile banking apps, and more.

What services are provided by a fintech development company?

Fintech software development company provides custom development, implementation, testing, integration and other services related to fintech adoption and handling after-implementation effects. These companies act as technology partners to banks, insurance companies, fintech startups, and regtech businesses.

We can become your trusted partner, equipping your company, startup, or individual project with the right technology, latest insights, and thoroughly analyzed features targeted to engage and satisfy your target audience. We provide full-on assistance with every type of service we deliver, giving you long-term value.

How much time will it take you to develop my fintech software?

The duration of fintech project varies and usually depends on lots of factors. Mainly, these factors include the project scope and complexity, chosen technology and platforms, time-to-market urgency.

What professional service delivery guarantees can you provide?

DICEUS is an expert team of highly experienced professionals with over twelve years of fieldwork powered by cutting-edge technologies and custom tools. We have efficiently delivered over 130 projects from eight offices situated all over the globe and house more than 250 specialists qualified in all relevant technologies, methodologies, and workflow organization approaches.

We leverage an extensive tech stack to provide over a hundred types of fintech software development services. We tailor development cycles to individual needs and offer custom services if you need something beyond our long list of offerings. We also boast tech partnerships, certificates, and accolades—check out our About Us page!