List of top insurance software to use in 2025

Effective and easy-to-use software is a vital factor for the insurance industry. Convenient, flexible, and user-friendly solutions can change the entire insurance process by simplifying labor-intensive and routine operations. Insurance agents and related professionals rely heavily on software during billing and claim management.

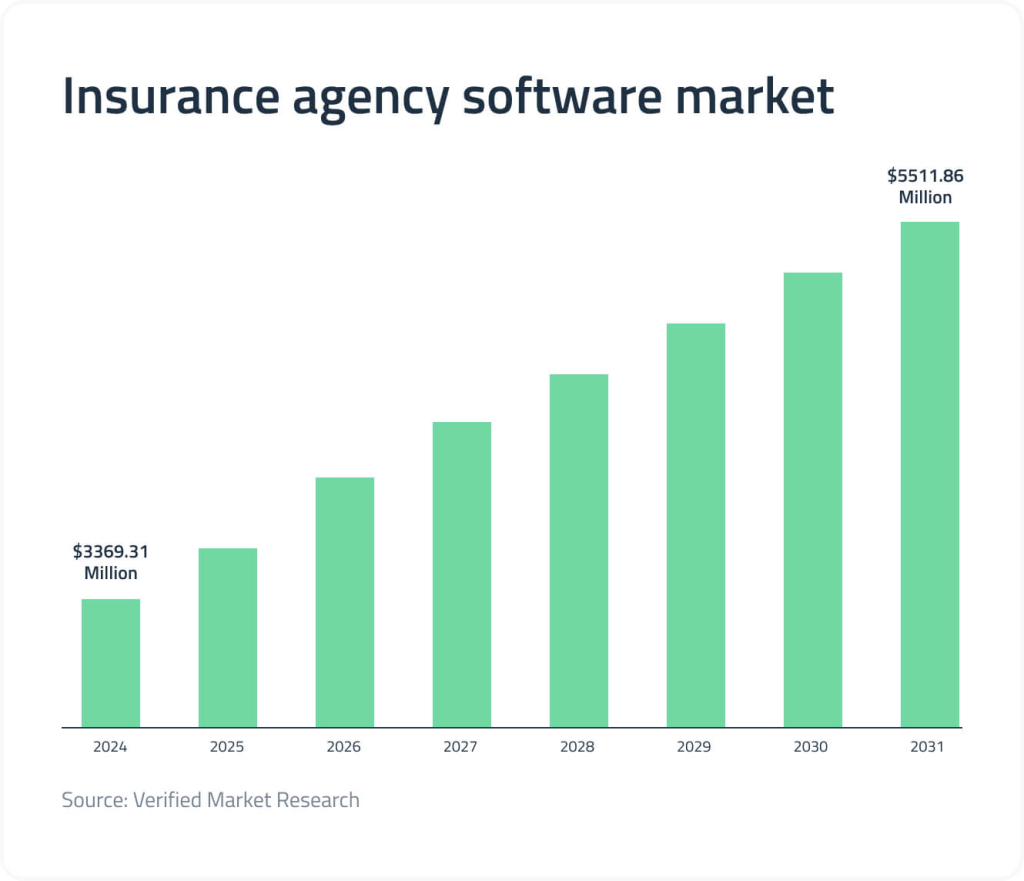

The better it runs for specific specialist needs, the more productive, prompt, and customer-oriented service the insurance agency can offer. According to the forecasts, the rapid growth of the insurance software market can reach up to $5511 million by 2031. This potential statistic only confirms the importance of the right software in this industry.

Today, we will have a closer look at insurance software types that can improve and make the agent’s work easier and more organized. We will review the most popular insurance software solutions and share our experience in the insurance field.

What is insurance software?

Talking about insurance software, we mean the variety of apps and systems that can assist managers, administrators, agents, and other specialists during the operation of insurance companies. Advanced technology with automation potential, like AI and machine learning, streamlines basic insurance processes throughout. It can improve the availability of services and interactions both for staff and customers, boosting the quality of service.

Smart administrative and management software helps arrange much better-organized document management, make policy administration easier, and automate workflows to reduce the required amount of time and resources. As for the customer’s side, insurance software provides an opportunity to log in to the system and check the policy status and information, fill out forms, complete payments, and handle other actions.

Insurance software trends

By analyzing dozens of requests from our customers from the insurance industry, our team has come to the conclusion that insurance is influenced greatly by the advanced technologies and ever-changing demands of modern policyholders. We distinguish the following trends that will rule digital transformation in the insurance sector for the next few years:

- Trend 1. A transition from traditional communication channels to digital ones. With the evolution of technologies and ubiquitous digitization, customers of insurance companies seek convenient ways of buying policies and submitting claims, minimizing their communication with insurers. Thus, the latter have to shift from traditional ways of communication to more cutting-edge means like mobile apps, web portals, and chatbots. These digital channels allow for providing quick online services for clients, not involving many staff. The possibility to purchase insurance online, right in the mobile app or through a chatbot, makes customers more satisfied with the provider and its services.

- Trend 2. Insurance processes are becoming more automated. As you know, traditional insurance is all about paperwork, redundant and manual work, and time-consuming claim processing. With the development and implementation of advanced technologies based on AI, insurers started to automate their processes. For example, by implementing Optical Character Recognition (OCR) technology, insurance carriers can automatically recognize text and numbers in digital documents without involving operators, saving them time for more important jobs. The same goes for image recognition tools that can assess the level of damage by analyzing the image sent by the customer through online channels of communication.

- Trend 3. New ways to engage customers. Indeed, it’s pretty difficult to surprise anyone with a dedicated mobile app or chatbot nowadays. So, insurers have to think of new ways to engage their customers and attract new ones. It can be achieved with the help of unique capabilities provided to customers through digital channels. For example, our Vitaminise solutions for insurance companies offer an online symptom checker, a digital wallet for insurance policy cards, telemedicine, a preventive medicine module, and many self-service functionalities that make these solutions highly competitive in the market.

Along with our Vitaminise solutions, DICEUS offers custom software development services for the insurance industry: data warehouse development, core insurance system development and modernization, API integration, and more. Let’s see what types of software we may work with.

Types of insurance software

Insurance companies handle many key processes with software, from administrating policies to sending a notification for a policy renewal to the customer. Most key processes can be managed with the help of core insurance systems, encompassing policy management, claims management, underwriting, and customer relationships management. Below are the most widely used types of insurance software that may all function as part of a core insurance system or separately as stand-alone modules:

- PAS (Policy Administration System)

Policy administration systems manage the whole insurance cycle, from policy purchases to renewals. - Underwriting software

Advanced analytics technology powers well-informed decision-making and efficient risk assessment, automating underwriting procedures. - Claim management systems

Software for claim management helps streamline claim processing, smooth out customer service, and keep all sides informed. - Custom billing and payment systems

Customized software grants efficient and error-free billing management, payment collection, and financial transactions tied to policies. - Document management

This tool is a must-have for insurance agencies due to the vast amount of data provided. It helps to organize, store, and retrieve any documentation within the agency. - Reinsurance management

Software systems for reinsurance are designed to manage interactions with reinsurers related to contract renewals. - Analytic and reporting software

Such tools analyze data and provide valuable insights into agency performance, customer behavior, and possible risks. - Management systems for agents and brokers

This kind of software is focused on agent-broker interaction management related to commissions and performance tracking. - CRM

Customer Relationship Management solutions allow agents to manage and track client interactions and store records about them in one place. - Customer engagement platforms

Such platforms serve for customer self-service related to policy management, claims filing, and customer support via various chatbots through portals and apps.

Need to update your core insurance system? Read more about core system modernization.

Insurance software modules and integrated tools for customers

We have already mentioned customer engagement platforms above. These may include not only web portals but also mobile applications and chatbots. So, let’s see how these modules work.

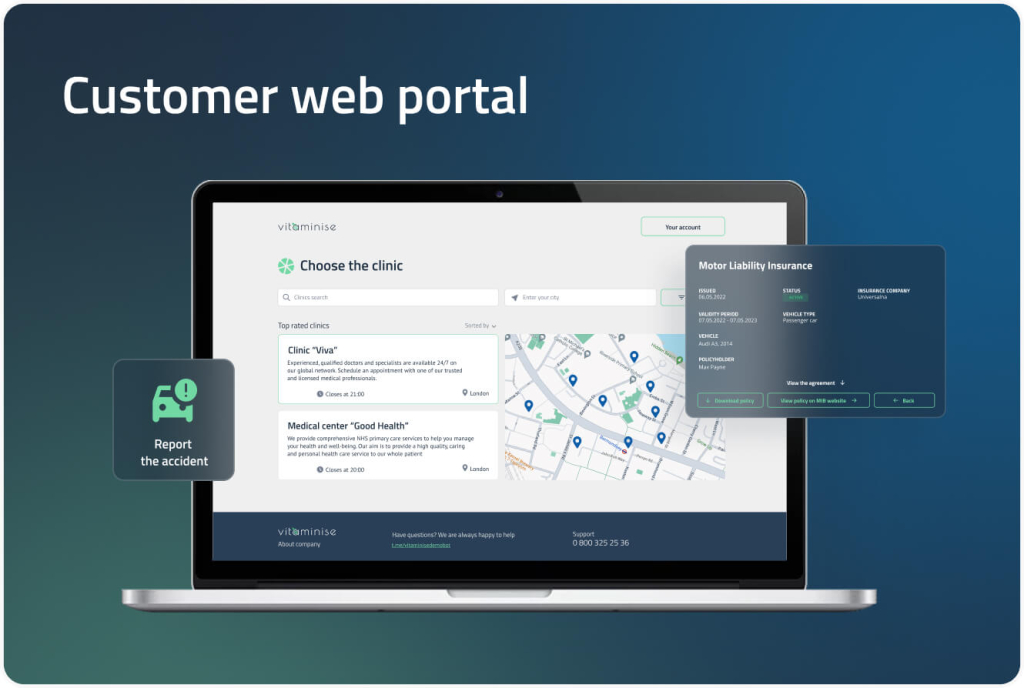

A customer portal is a self-service platform where policyholders can view information about their policies and modify them. Usually, these portals allow us to upload and download documents and track history and claim statuses.

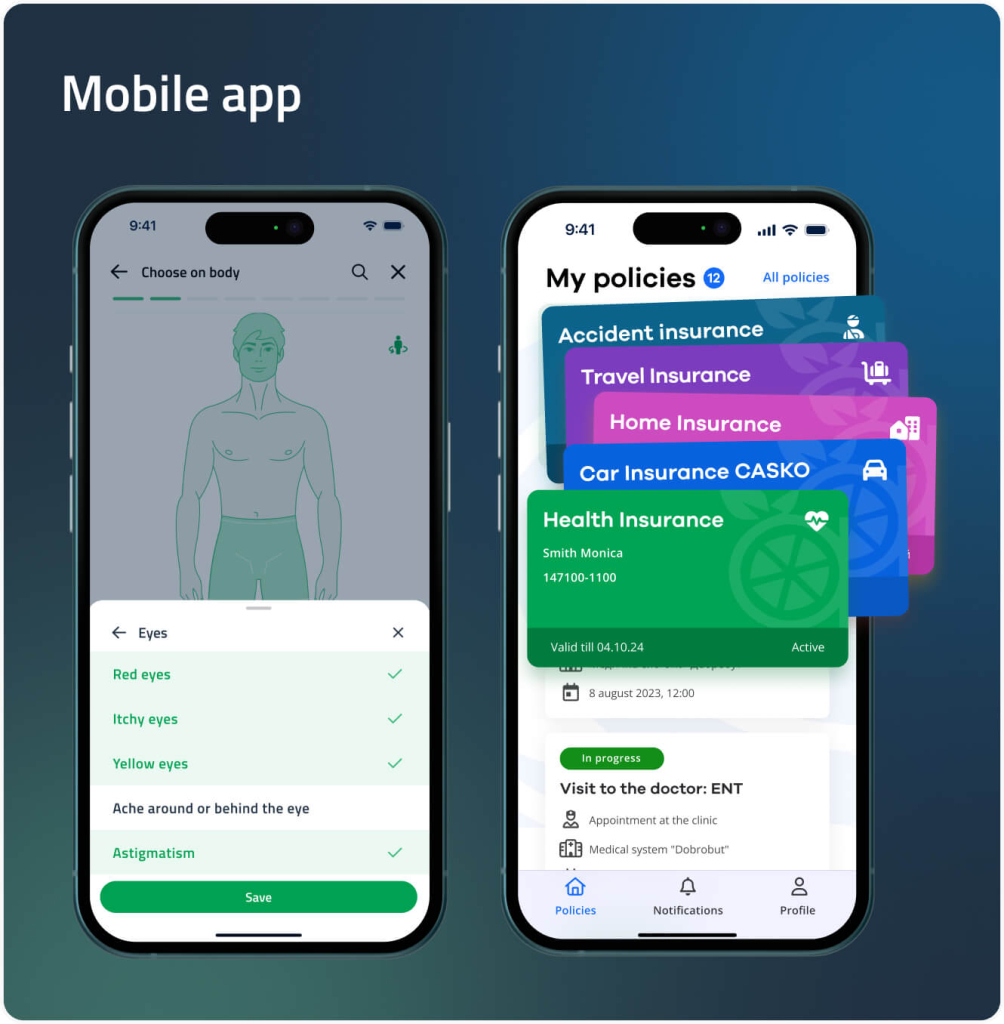

Mobile apps provide policyholders access to their accounts and insurance services. Modern applications offer a wide range of convenient features: electronic insurance cards, push notifications for renewals, claims, and payments, live support, and claim filing with the ability to send supporting photos or videos.

Discover Vitaminise Mobile App for insurance

The quote management module is a tool that allows you to browse through various insurance products, compare them, estimate premiums, and generate quotes.

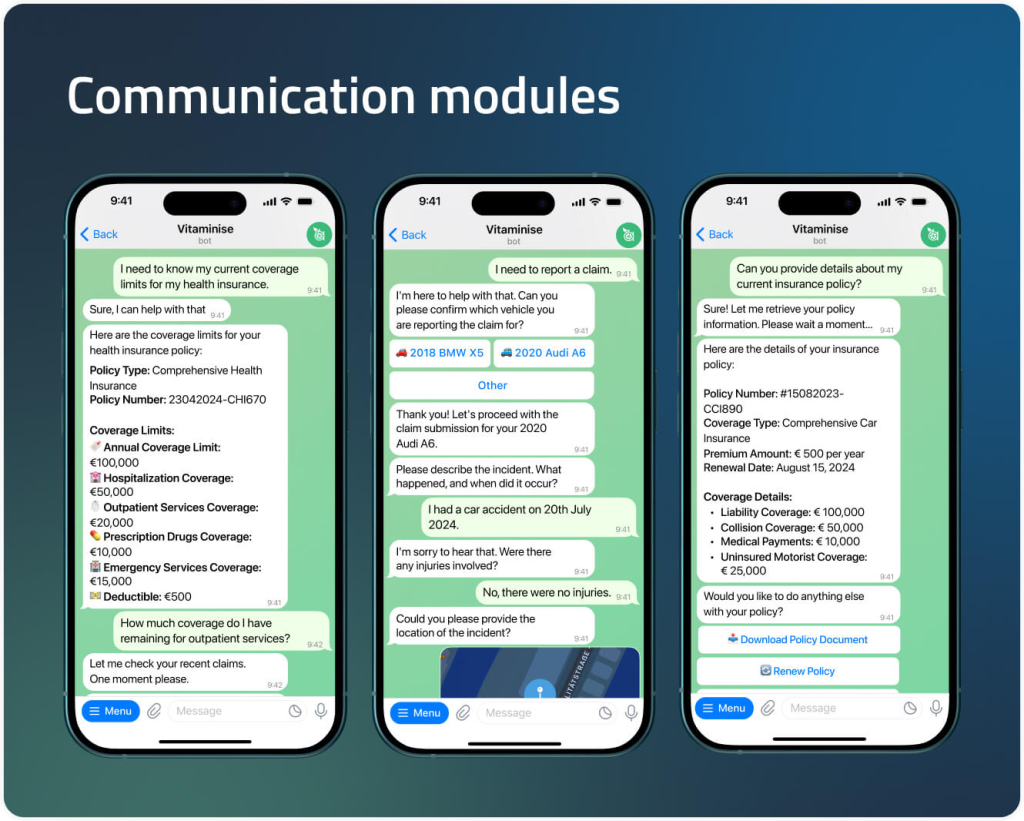

Communication modules, including chatbots and omnichannel systems, enable seamless interaction between insurance companies and customers via multiple channels like email, web, mobile app, SMS, and more. Usually, these modules are integrated with the most popular messenger platforms like Telegram, WhatsApp, and Viber.

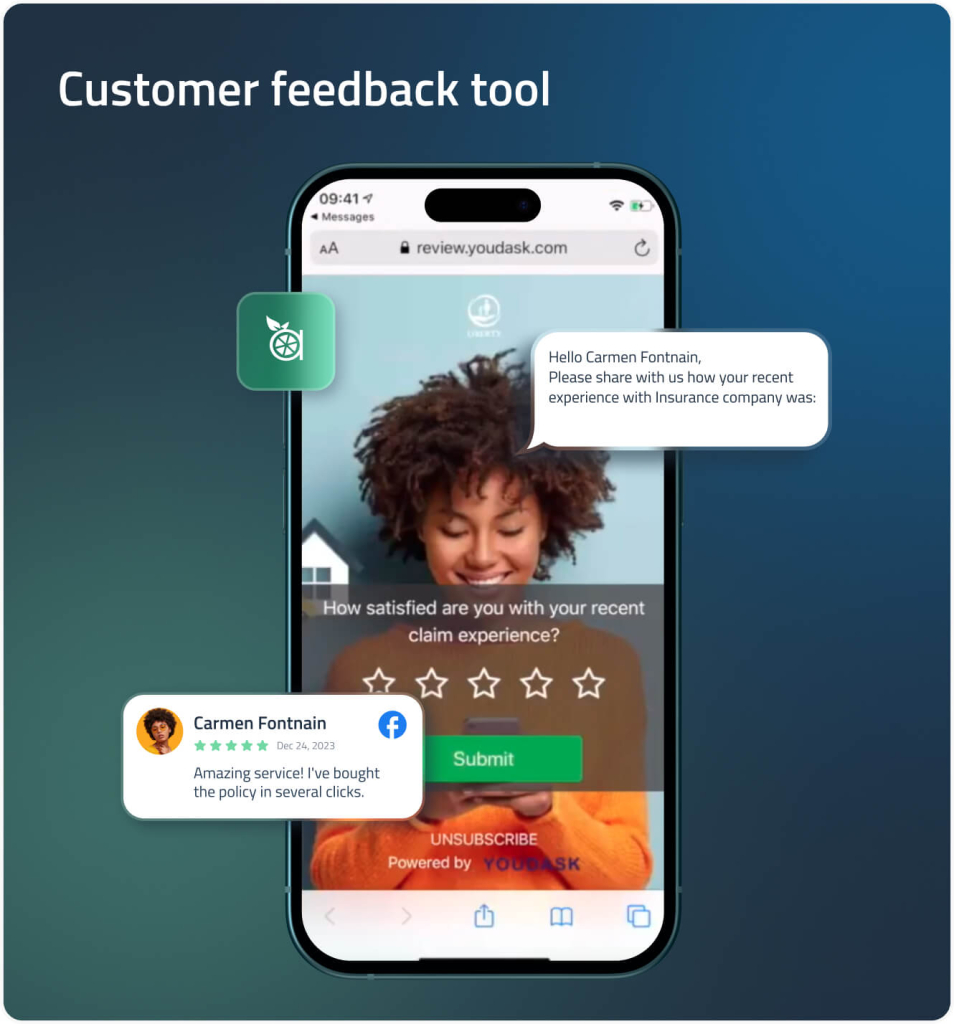

Customer feedback tools gather customer feedback and allow it to be shared on social media or the insurance company’s website. These tools help carriers understand customer pain points better and see which products are most loved by customers.

Top insurance software examples

A variety of software solutions for insurance companies can be confusing when choosing specific solutions for a new software stack. Let’s look at the most popular options for insurance software and find out what makes them valuable for users.

Vitaminise by DICEUS

Vitaminise is a next-gen CX automation and data platform consisting of five products: a mobile app, chatbot, web portal, customer feedback tool, and data analytics. These tools empower insurers to offer self-service features like policy purchases, claim submissions, and complimentary services like appointment scheduling and telemedicine. Vitaminise products can be implemented individually or as a unified omnichannel system, allowing you to create a seamless customer journey, decreasing operational costs and improving customer engagement.

INSIS by Fadata

INSIS is a core insurance system that allows to effectively manage the majority of crucial insurance processes. Fadata is recognized by analysts as a market-leading solution provider. Our company is an official INSIS implementation provider.

Guidewire InsuranceSuit

Guidewire InsuranceSuite is considered one of the most reliable insurance software solutions. It comes with a range of integrated features for effective operation management. The featured options support product definition, adjustable market distribution, underwriting, and policy management.

The Duck Creek Suite

The suite offers a combination of systems and applications that can be selected and integrated one by one or as a whole set. It helps with policy and claims management, provides systems for policy and content distribution purposes, and tools for digital engagement.

ALIP software

ALIP is Accenture’s Life Insurance and Annuity Platform. The main priority here is property and casualty aspects management as well as automated life, annuity, and group insurance benefits. As a common trait of insurance software, it has a strong policy administration base and tools for claims processing, distribution management, and analytics.

Majesco P&C Intelligent Core Suite

This property and casualty software solution suits workers’ personal and commercial compensation tools. It offers an insurance-valuable set of features for policy management, billing operations, claims processing, and simplified task fulfillment.

BlueMind application

BlueMind software is powered by artificial intelligence, making it a cutting-edge solution for insurance agencies. With a primary focus on process automation, Bluemind helps reduce the time required to process insurance applications at all stages.

Insurity Sure Suite

The Sure Suite has integrated product features to cover the main parts of insurance work: processing of policies, billing, claims, payments, and underwriting. It is also equipped with good insurance analytic capabilities and offers the help of a built-in artificial intelligence assistant.

The Adaptik Suite

The Adaptik Suit is a flexible and comprehensive insurance solution designed specifically for P&C insurance agents. This software suite has tools for policy administration to streamline common processes, automated underwriting, reporting, and analytics. A flexible set of tools also allows in-depth modification of insurance products.

iPipeline

Software solutions provided by iPipeline are focused on digitizing user workflows and interactions. The platform is designed to streamline regular processes, including quoting, underwriting, and policy insurance.

Top insurance software comparison

It would be incorrect to compare only these ten software solutions mentioned above as they are pretty different, serving various business lines, markets, and processes. However, we consider it quite fair to compare ready-made solutions and custom software.

| Feature/Aspect | Ready-made solutions | Custom software |

| Cost | Lower initial cost | Higher initial investment |

| Implementation time | Quick to implement | Longer development time |

| Customization | Limited customization options | Highly customizable to specific needs |

| Scalability | May have limitations | Easily scalable with business growth |

| Support and maintenance | Standardized support | Tailored support based on specific needs |

| Integration | May integrate with popular systems | Custom integration with existing systems |

| User experience | Generic user interface | Designed specifically for user needs |

| Compliance | Built-in compliance features | Requires ongoing updates for compliance |

| Updates and features | Regular updates from the vendor | Updates depend on your development team |

| Ownership | Licensing fees, vendor-controlled | Full ownership and control |

| Flexibility | Less flexibility for changes | High flexibility for changes |

| Data security | Vendor-managed security | Control over security protocols |

| Innovation | Limited to vendor’s roadmap | Opportunity for innovative features |

Top advantages of custom insurance software

So, how do insurance companies benefit from tailor-made software?

- Tailored functionalities. Unlike out-of-the-box insurtech solutions, custom-developed systems meet customer demands better. That’s because a discovery phase, called business analysis, precedes design and development. During this phase, a development provider’s team conducts in-depth research on your business goals, workflows, and customers, discovering their pain points and creating customer portraits. Based on the research, CX researchers create customer portraits, user journey maps, and requirements for a new UX and UI. Software architects and engineers, in turn, also discover the existing system and current challenges to offer you the most effective new solution and recommend a tech stack. So, as you see, in this way, a final product is built based on profound research and requirements, aligning precisely with your company’s needs.

- Integration layer. Custom insurance software is built with regard to the integration layer. It connects various systems such as policy management, claims processing, CRM, and external services like payment gateways or regulatory databases. Such layers usually ensure smooth data exchange between these platforms, enabling real-time updates for customer policies, claims status, and premium payments. For instance, when a customer files a claim, the integration layer can orchestrate communication between the claims system, fraud detection tools, and underwriting systems. It also transforms data formats to ensure compatibility across legacy systems and modern APIs.

- Competitive advantage. By providing your customers with innovative and convenient functionalities, you will stand out from the crowd. Custom insurance software enables faster policy management, self-service portals, and personalized product recommendations, enhancing the customer experience. With real-time data processing and automation, insurers can respond quickly to claims and inquiries, building trust and loyalty. Additionally, the ability to integrate new technologies, such as AI-driven underwriting or telematics, ensures that your offerings remain relevant and competitive. This agility helps you adapt to market trends and regulatory changes, giving your business a long-term edge over competitors.

Why choose DICEUS as your insurance software development company?

Finding a reliable partner that could develop the insurance software specifically for your needs is the first step to successfully integrating any of the abovementioned solutions or custom tools.

Experiencing a lack of technical expertise and skills?

Connect with a professional team to address your project challenges.

Our custom insurance software development services

DICEUS offers innovative technological solutions and software development services for insurance companies in the A&H and P&C lines of business. We deliver projects for UNIQA, Vienna Insurance Group, Zurich, Willis Towers Watson, Raiffeisen Bank, and others. Our services for insurance companies include:

- Core insurance platform development and implementation

- Integration services

- CRM development

- Data warehouse (DWH) development

- Data analytics and reporting

- End-to-end custom software development services

- Discovery

- UX/CX research

- UI design

- Custom software engineering

- Testing

- Tech support and maintenance

Our Vitaminise ready-made solutions for insurance

Recognizing the demand for modern insurance solutions, we developed Vitaminise, a next-gen CX automation and data platform consisting of five products: a mobile app, chatbot, web portal, customer feedback tool, and data analytics. Critical features of Vitaminise are as follows:

- Policy purchase. Customers can buy policies directly through the app and store them in a digital wallet, which allows them to easily access and manage all their insurance products in one place.

- Self-service Symptom Checker (Avatar). The app features an advanced self-service symptom checker that provides users with a potential diagnosis and directs them to the right healthcare provider, helping to reduce unnecessary claims.

- Doctor appointments. Users can book appointments with doctors via the app, saving time and reducing the need for contact center involvement. The app even offers location-based clinic suggestions.

- Telemedicine. Users can instantly connect with healthcare providers via video or message chat, enabling convenient and quick access to care without leaving the app. The cost of a claim handled online is lower than offline.

- Lab test and medicine delivery scheduling. The app lets users schedule lab tests and arrange medicine delivery, optimizing convenience for policyholders.

- Image, voice, and video recognition. For car insurance, the app uses image recognition technology to allow users to submit damage reports via photos or videos, streamlining the claims process.

- Preventive medicine and wellness programs. Vitaminise encourages policyholders to adopt healthier lifestyles by offering rewards through wellness programs, which can help insurers reduce future claim costs.

- Chatbot. Our LLM-powered chatbot provides a personalized, conversational experience, allowing users to purchase policies, file claims, or get support through voice or text in real-time human-like conversation.

Vitaminise offers a comprehensive suite of products designed to help insurers reduce operational costs, improve customer engagement, and drive revenue growth. With features like policy purchase, symptom checking, telemedicine, and claims automation, we ensure a seamless experience for customers and insurers. If you want to explore how Vitaminise can transform your operations, feel free to reach out for a demo.

Conclusion

Well-personalized, custom insurance software is a necessity in the modern digital world to optimize your current workflows and improve the service level for customers. Insurance software can significantly enhance professional possibilities, save time and money, and help with routine tasks and complex processes. By integrating customized insurance solutions, you invest in market-defining technologies to help you stay at the forefront of the insurance industry.

The available variety of popular solutions allows you to choose the one ready for your business. If you prefer to create unique software for your insurance company, DICEUS will gladly help you achieve your goals.

Frequently asked questions

How does insurance software improve efficiency in 2025?

Proper insurance software can help automate basic processes and make repetitive tasks less time-consuming and human-involving. Specialized software tools can assist with data entry, claims processing, and policy management. Analytics tools provide insights into potential risks, statistics on customer behavior, and the agency’s general performance. Various CRM and financial software options support simple access and collaborative possibilities. Automated customer service helps make the procedure more accessible and more user-friendly. In short, insurance software makes the daily routine simpler but more efficient.

What features should I look for in the best insurance software of 2025?

You should focus on software solutions that are easily integrated with other tools and platforms to get the best possible advantage from all services. Pay special attention to automated and analytics tools, as they can enhance overall agency performance and significantly streamline workflow. Customizable options will help adjust the software according to the unique needs of your business. Investing in self-service solutions for customers will help cover 24/7 customer support. And don’t forget about data protection and security measures to ensure your systems run safely.

How can insurance software help with regulatory compliance in 2025?

Good software can reduce the time, money, and effort required to monitor changing regulations. Insurance software can provide automated checks on industry compliance to ensure everything works according to regulations related to policy insurance and claim procedures. Real-time updates on changes will help your company adjust the policies and workflow in time. With the help of automated reporting features, you can quickly generate compliance reports.

What are the benefits of using cloud-based insurance software?

Cloud-based insurance software is well-known for its high adaptivity and scalability. It is prepared for business growth and does not require significant investment in money, unlike on-premise solutions. Cloud-based software is available anywhere with an internet connection and offers better support for remote work and collaboration. Service providers are responsible for in-time updates and maintenance. The flexible nature of cloud solutions makes them more convenient for communication between teams and with customers, thanks to the capability of shared data access.

How to choose the right insurance software for my business?

Concentrate on your goals and identify the specific needs of your company. Define what challenges you want to fight with the new integrations and your requirements for features and functionality. Compare software options to find the one that most suits your needs. Keep in mind the possible scalability of your insurance agency to choose the most suitable option. Check for user feedback to make sure that your choice is reliable. Study integration options and the possibility of further support. Lastly, contact DICEUS, and we will help you develop the most efficient solution tailored to your requirements.