Artificial intelligence in health insurance: Main advantages

AI opens many possibilities to upgrade workflow convenience, speed, effectiveness, and productivity. You can feel its impact in nearly every modern industry, and health insurance is no exception. We invite you to learn more about AI’s influence on the health insurance sector. This article will show the role and benefits of AI in the insurance area.

Need to integrate AI? Check out our AI and other services for the insurance industry.

Use cases of artificial intelligence for the health insurance industry

Artificial intelligence transforms the healthcare sector by optimizing numerous tasks, such as:

Claims processing

AI automates and speeds up the routine procedures of claim processing, providing an accurate analysis of claim data. The ability to indicate fraud patterns this easily—on-demand—accelerates and streamlines claim approvals significantly.

Underwriting

AI enhances underwriting processes with the help of predictive analytics, which allows you to achieve more accurate risk assessment results. A deep analysis of diverse data sources helps understand potential applicants’ risks, if any. Health insurance companies also receive reliable information on potential premiums.

Customer service

Customized virtual assistants guarantee prompt round-the-clock support, generating instant responses to common queries and processing simpler policy changes (ones that don’t require complex investigation) on the go. A smart chatbot can also cover billing issues and status updates, boosting in-house productivity dramatically.

Personalized assistance

AI-powered tools analyze customer data to tailor service coverage options and premium rates, enabling health insurers to suggest solutions that fit specific customer needs and risk factors. Furthermore, a personal approach is key to customer satisfaction with insurance services.

Fraud detection

Automated pattern analysis helps in detecting suspicious activities and anomalies in claim data. Traditional manual methods can miss fraudulent behavior because of human factors. Meanwhile, machine learning algorithms provide deep, accurate checks, cutting the workload for investigators and saving major costs.

Risk management

AI-powered tools can be tuned for improved risk management. Specialized models can predict and analyze potential risks and dangers, enabling better proactive solutions and advice to policyholders. As a result, the number of claims and losses is reduced, and you get to set up a failproof digital infrastructure.

Data analytics

The AI-powered advanced analytics tool is a source of deep insights that carefully studies market trends and digs into customer behavior. The more data you have, the more informed decision you get to make. This intelligent, data-driven approach makes a sturdy base for competitive strategic planning.

Operational efficiency

Artificial intelligence impacts efficiency by automating administrative tasks. With optimized processes, you need less manual assistance. It allows your staff to work on other time-consuming matters, shifting manual labor to where it’s needed the most and eliminating tons of extra expenses.

What advantages can AI bring to health insurance?

The AI’s market size scaling and technological evolution push companies to invest in its development to get more benefits in the future. At the moment, AI can offer the following improvements to the health insurance industry:

- Advanced procession of claims. AI studies medical records and analyzes claims based on any sight of incorrect information. It ultimately expedites approvals and reimbursements.

- Enhanced protection. Specially trained AI models can efficiently detect unusual billing patterns or unreliable healthcare data for improved fraud prevention.

- More person-oriented health management. AI-powered platforms can tailor and maintain personalized wellness programs that suggest targeted propositions to get better health outcomes individually.

- Lower risk with predictive analytics. Smart systems study historical health data and lifestyle information, helping to predict potential health problems and adjust insurance premiums accordingly.

- Instant customer support. Chatbots assist with disclosing insurance coverage information, filing claims, and responding to common requests 24/7.

- Automated routine administrative procedure. AI assists with policy renewals and updates to make insurers focused on other value-added work.

This list of clear examples demonstrates how much AI can bring to health care. It makes artificial intelligence an attractive target for future investments and development.

Challenges of implementing artificial intelligence in health insurance

Implementing artificial intelligence comes with several challenges of its own, including:

Personal data protection

Data privacy and security are always among the main focuses in any industry. Insurance providers operate with large amounts of sensitive information about patients. Even the smallest security violation can lead to felt consequences.

Solution: Smart protection measures will fix this issue. Your insurance software should comply with all common regulations (GDPR in Europe and HIPAA in the US, state/federal regulations in the US, etc.). Also, make sure that only authorized staff has access to sensitive information through multi-level access and segmented authorization rules.

New AI for an existing system

The integration of AI with legacy systems may require extra time and effort. Health insurance companies often stick to outdated IT architecture solutions. Unfortunately, legacy solutions do not always work well or run at all with modern technologies like AI.

Solution: To make legacy software and up-to-date AI work together, you may need to implement major upgrades to the legacy system, refactor it in places, or even migrate. At DICEUS, we help make this process resource- and cost-efficient, achieving smooth compatibility with AI technology.

Team qualification

AI integration requires knowledge of AI technology, machine learning, data science, and others. Health insurance providers rarely have such experts on their existing staff. However, the presence of qualified experts is required for unraveling AI’s full potential.

Solution: Consider cooperation with a team of professional developers. A reliable partner is half of success. Make sure you check your partner’s reputation and expertise. The capabilities of your AI will directly depend on their knowledge base.

Experiencing a lack of technical expertise and skills?

Connect with a professional team to address your project challenges.

Unwanted expenses

Development, testing, and integration require time and money investments. Creating the new AI model from scratch is a high-cost procedure. The same goes for integration with existing legacy systems and staff training. Such expenses can be tough to bear for small health insurance companies.

Solution: Review the possibility of working with a less expensive pre-trained model. Collaborations with technology companies may also help in this situation. Consider scalable AI options to prolong your AI model’s effectiveness as much as possible.

Ethics

There are many concerns about biased algorithms that could cause incorrect treatment. The risk of compromising the decision-making process can have a significant impact and requires close consideration.

Solution: You need to reach transparency in the decision-making procedure. Make sure that artificial intelligence operates according to in-house ethics guidelines. Regular checks and adjustments will help exclude possible biases in data.

Each challenge requires sophisticated evaluation. You need to see if it is a concern specifically for your insurance company. Taking them seriously will help stay prepared and find working solutions for enduring risks.

Related article: Artificial intelligence in customer service

How to integrate AI into health insurance

DICEUS prepared a simple guide that will help you get ready for AI integration. Let’s take a closer look at five simple steps to successful integration.

Step 1 – Prepare your insurance company for integration

First off, you need to evaluate your company workflow. Check infrastructure and inherent capabilities to see what basis you have for integration. It will show if your company is ready for implementation or if there are still some issues that you need to take care of first.

Your hired developers need to have a clear picture of the company’s workflows. Knowing the requirements, they will be able to tailor AI closer to your expectations. Make sure that you have diverse, well-organized data for future model training. Leverage electronic health records as a data source. Claims data and insurance reviews can also be helpful.

Step 2 – Choose the areas for AI impact and set your goals

Now, you need to decide what part of existing workflows can and should be delegated to AI. Evaluate daily operations to detect bottlenecks. Define weak points of your working process to see what can be improved with AI integration.

Are there any delays due to administrative overload? Is the existing booking system efficient enough? Should it be replaced with an automated one? Do you want to expand your customer support with a chatbot to cover more time and patients?

Decide what successful integration will mean specifically for your company. Set the main goals. After this, you will be able to choose the features you need for process improvements.

Step 3 – Find a reliable partner

Successful integration requires relevant skills and knowledge base. The presence and professional guarantee of both ensures the process goes smoothly. Don’t be afraid to ask about previous work cases and the types of projects your hired specialists were involved in.

Case studies will help you better understand what your tech partner is capable of. You need technical experts with relevant expertise in the AI sphere. Seek a combination of good reputation and professional knowledge.

Step 4 – Integration

Your hired expert team will help choose the required tech and define technical requirements. When it comes to AI training, development experts are responsible for the technical part. From your side, you may need to provide experts in the healthcare field.

They are going to set up close cooperation with AI in the future. But their present mission is to evaluate how effectively algorithms work. Once the AI is integrated, train your staff to work with the updated system. We can help by sharing experience and mentoring.

Step 5 – Monitoring

Keep in mind that AI integration is a continuous process. Even after all work is done, stable monitoring is required. It will help provide in-time upgrades and adjustments. Timely improvements optimize the workflow and help achieve better customer satisfaction. Feedback from users (both healthcare experts and patients) is especially valuable.

Learn more: Core systems modernization in the insurance industry

DICEUS AI expertise for health insurance

We have worked with insurance companies for years, providing advanced solutions for various goals. For them, we have created cloud-based insurance software, self-service tools, and mobile applications. Some of our stand-out use cases of ours include a powerful chatbot for Kniazha Insurance Group.

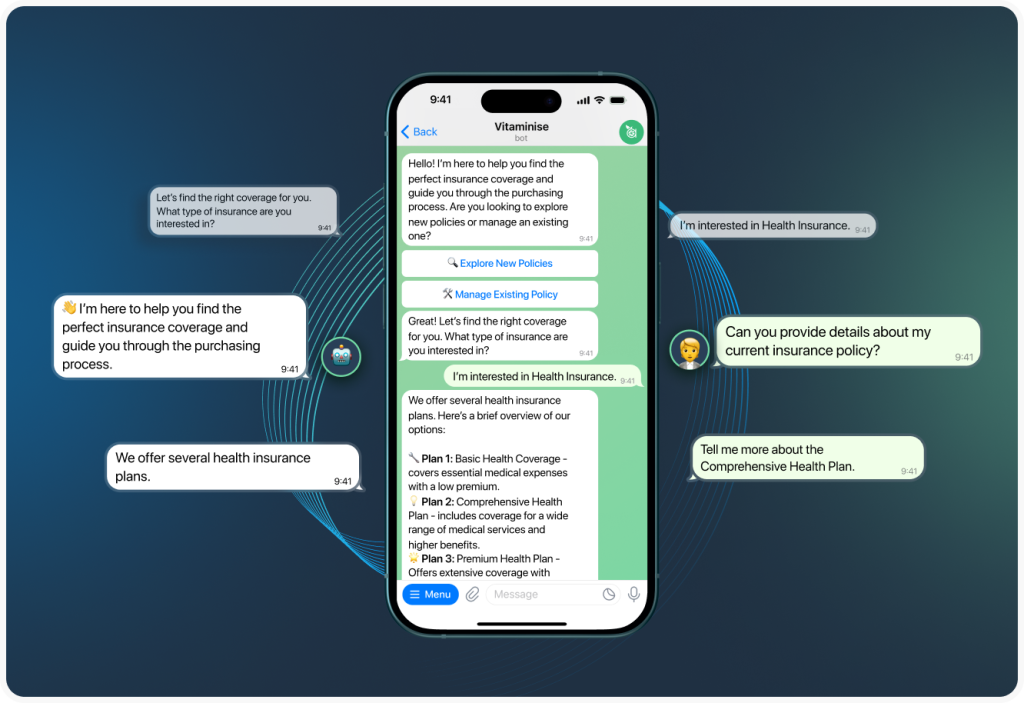

Vitaminise case study

Let’s look closer at our Vitaminise project as an example of powerful AI integration. It is an LLM-based software with the ability to recognize text and voice messages. The intensive training made this AI model understand the context clearly. It acts accurately according to prescribed scenarios.

AI in Vitaminise is a useful helper during policy purchases or claim creation. Here is what users can do with the help of the new AI chatbot:

- Get personalized offers and pricing

- Fill claims with chatbot guides and add proofs for claim cases

- Review claim history at any time

- Check the history of insurance policies and their details

- Leave feedback about interactions for further improvements

These integration results illustrate what essential options AI can offer to healthcare providers. With improved coverage and effectiveness, your agency or enterprise may ultimately reach more clients and help more clients per day.

Bottom Line

AI is no longer an unreachable technology. Artificial intelligence is a tool that you must leverage to bring workflow to a new level. AI automates the most vital procedures for insurance companies. It serves as a helper and reliable partner in daily work. Enhanced effectiveness, better data protection, and well-segmented user experience make up only a part of the whole universe of possibilities.

Frequently asked questions

How is artificial intelligence used in health insurance?

AI enhances weak factors in the insurance industry. It automates claim processing by analyzing large amounts of data. AI validates information faster. The approval procedure takes less time with the help of AI. Human errors are greatly reduced. AI greatly improves fraud detection by searching anomalies in claim data. AI can also significantly personalize health management with the help of individual health data analysis.

What is AI coverage in insurance?

AI coverage in insurance refers to its ability to enhance and streamline regular processes. It offers various AI-driven tools to make a significant part of processes automated. You can delegate the following functions to AI: customer support, fraud detection, claim processing, underwriting, etc.

Will AI replace insurance?

Artificial intelligence will not replace a good insurance system, but it will help transform its performance. It operates as an additional support and work partner. The insurance system involves complex decision-making, compliance, and customer services. All this still requires human judgment. So no, AI is not a replacement but an auxiliary tool and addition to the live workforce.

How is AI implemented in insurance?

AI is implemented through the following stages:

1) Collection of healthcare data from different sources, choosing the areas of impact, and setting the main goals.

2) Development of the algorithms by designing machine learning models with the chosen expert team.

3) Integration into the existing system.

4) Updates and constantly monitoring the AI system to ensure it works accurately and effectively.

5) Training the staff to work with the updated systems.