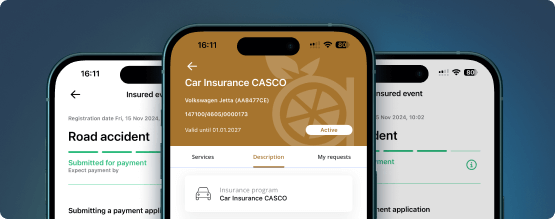

Vitaminise Mobile App for Investment and Life Cover Insurance Companies

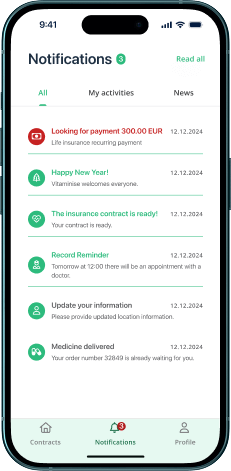

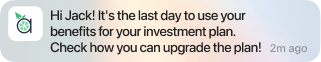

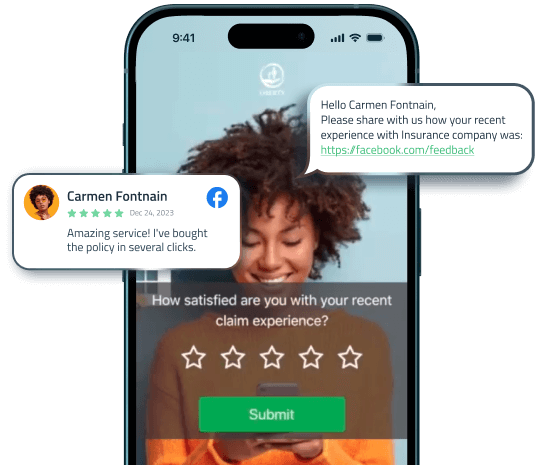

Vitaminise Mobile App is a multilingual native iOS and Android-based mobile application built for insurance companies. It delivers a first-class customer experience for policyholders and automates key insurance processes, including premium payments, fund management, switching funds, event-triggered proposals, and more.

Book a demo

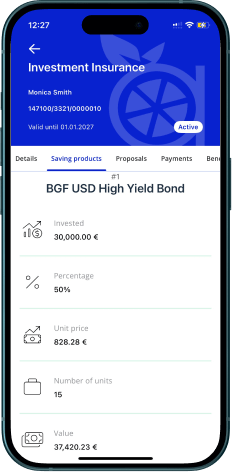

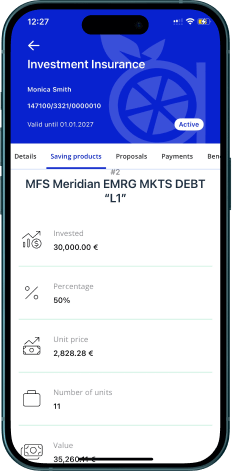

Investment insurance

Investment insurance

Policyholders can check the performance of their investments in the mobile app. That will increase the usage of the application and the likelihood that the user will use other functionalities or buy additional insurance products or riders.

The investment insurance card can show the total contribution of investments, current policy value, and the performance of total contribution on a predefined period basis – we can integrate any chart the insurance company wants to display.

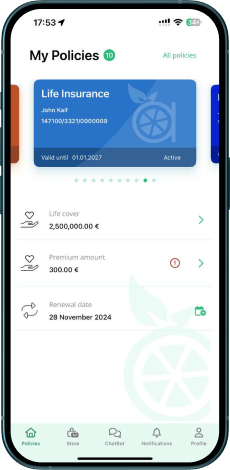

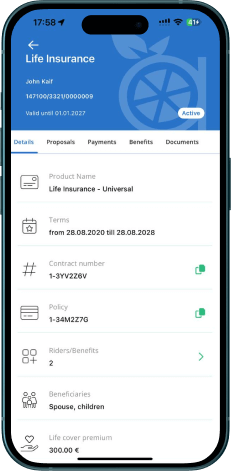

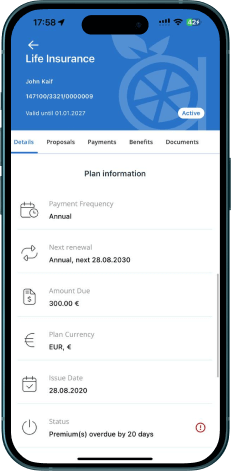

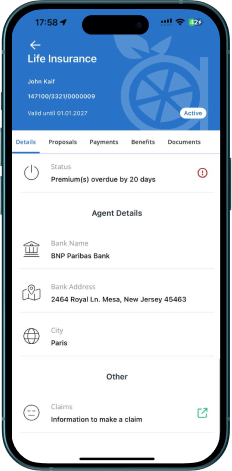

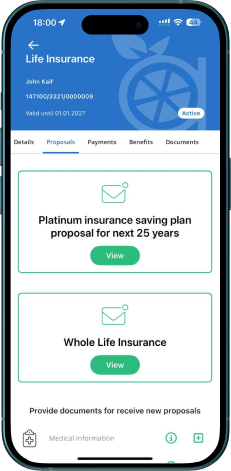

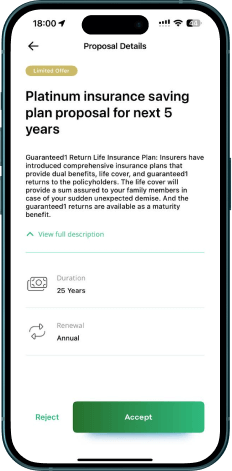

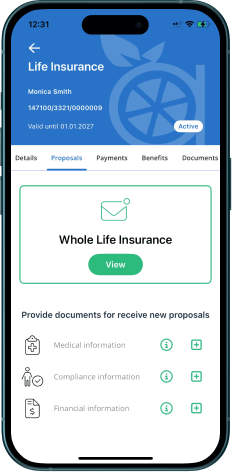

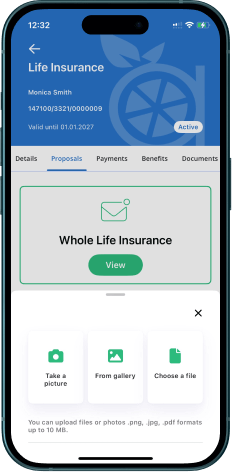

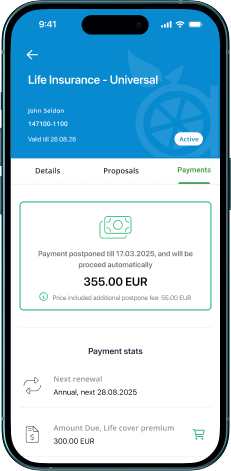

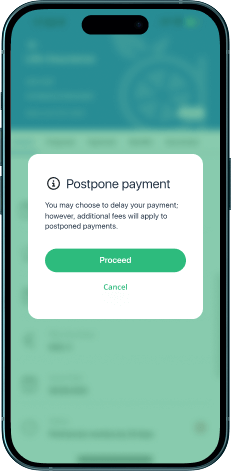

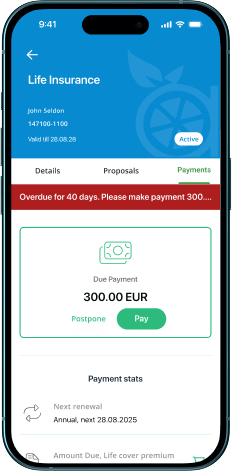

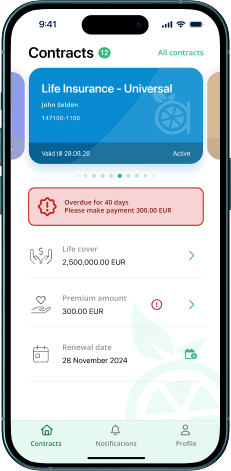

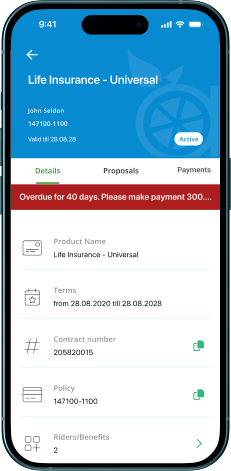

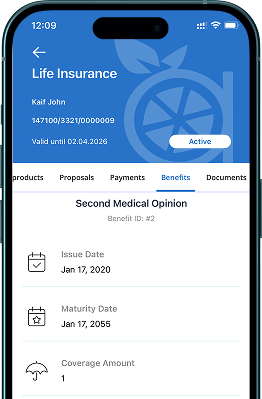

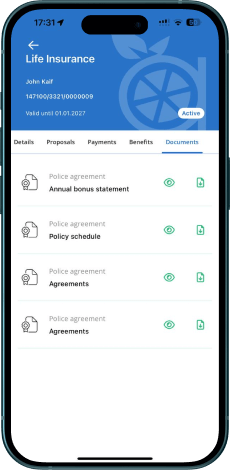

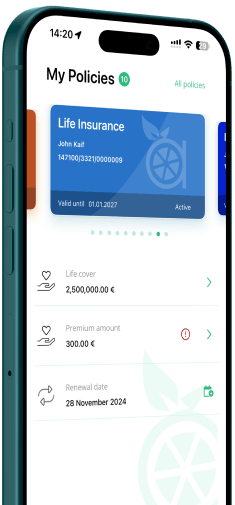

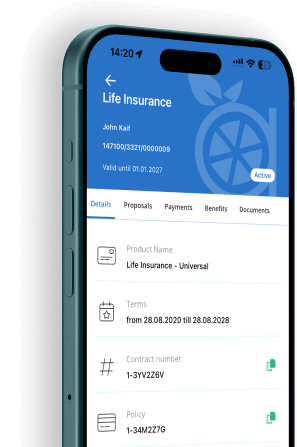

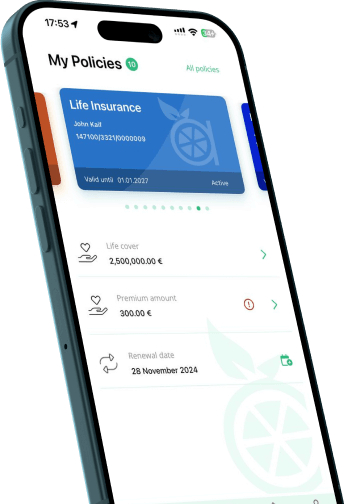

Life cover insurance

Life cover insurance

Vitaminise provides customers of insurance companies with a centralized repository to easily manage their life insurance, investments, and other products. The app fosters higher customer engagement, provides data-driven insights into customer preferences, and enhances operational efficiency.