Wealth management and investment software development involve designing and engineering custom software solutions to manage investments effectively.

These software solutions offer functionalities to manage portfolios, assess risks, plan finances, and analyze data. Technologies like AI, ML, and cloud computing help developers create platforms that provide personalized insights, automate routine tasks, and improve decision-making processes for financial advisors and investors. Additionally, robust security measures and adherence to regulatory standards are crucial for protecting sensitive financial data and ensuring that systems comply with industry regulations.

Benefits of wealth management and investment software

Embracing software solutions in the financial sector modernizes operations and offers many benefits that drive growth and efficiency. Here’s a look at the benefits of integrating wealth management software into your financial strategies.

Build software with custom features

Tell us about your requirements, and we will get back to you soon.

Key features of the wealth management and investment software we develop

Functionality is paramount in wealth management systems, and the demand for sophisticated, user-friendly features grows. Our development services focus on creating tools that meet and exceed these demands, ensuring users have a seamless and efficient experience. Here are some of the features we prioritize in our software development.

Can’t find a solution you are looking for?

Explore all servicesWant to discuss your project?

Contact usOur wealth management and investment software development services

Our company recognizes each client’s unique challenges and requirements, so our services are designed to offer bespoke solutions that align with individual needs. Here’s a closer look at the specialized services we provide.

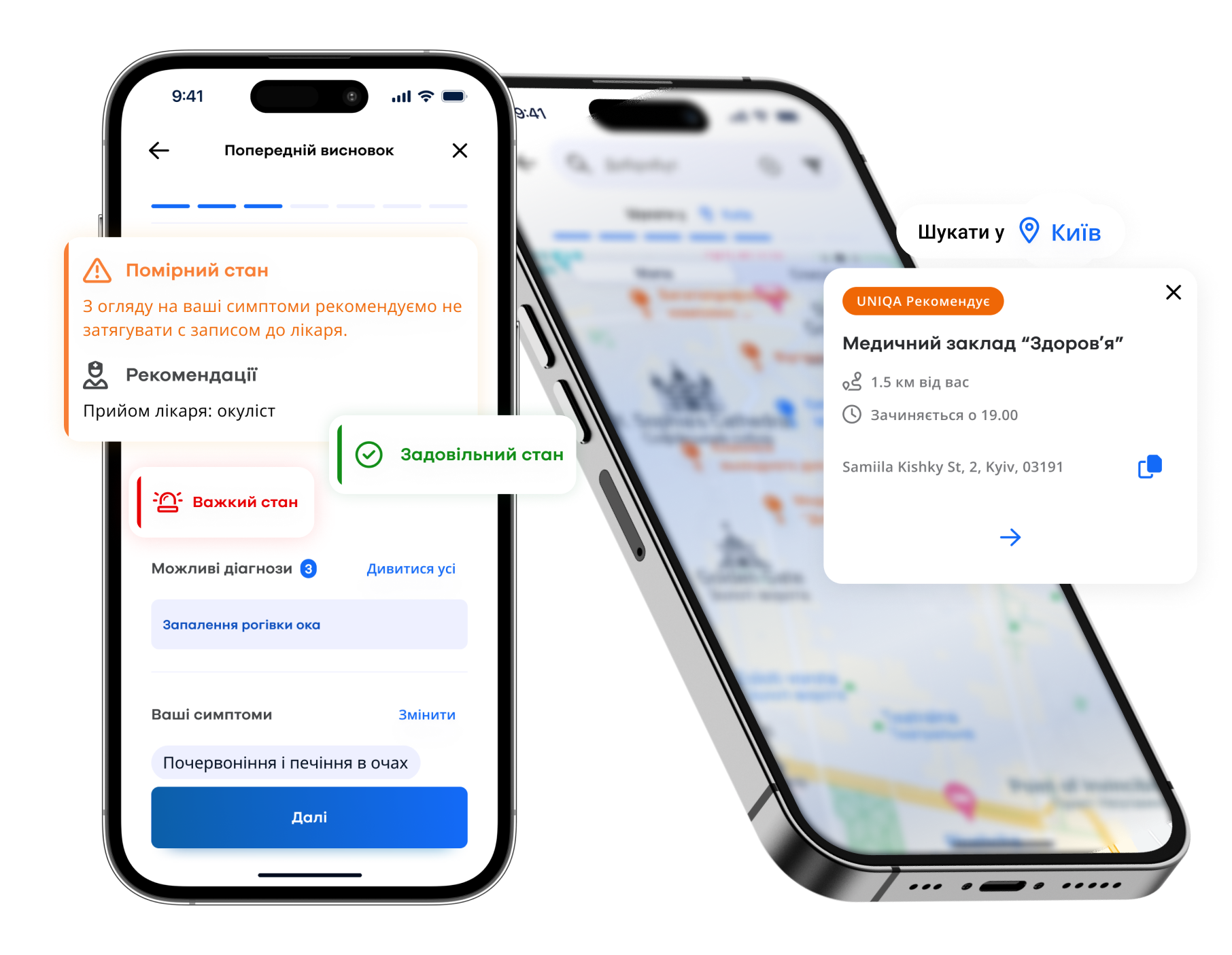

Custom mobile app development

The rise of mobile technology has revolutionized how investors manage and monitor their finances. We recognize this shift and offer custom mobile app development tailored to the wealth management and investment sector. Our apps are designed with user experience in mind, ensuring easy navigation, real-time updates, and secure transactions. Whether you’re an individual investor wanting to track your portfolio on the go or a financial institution looking to offer clients a mobile platform, our solutions are robust and intuitive.

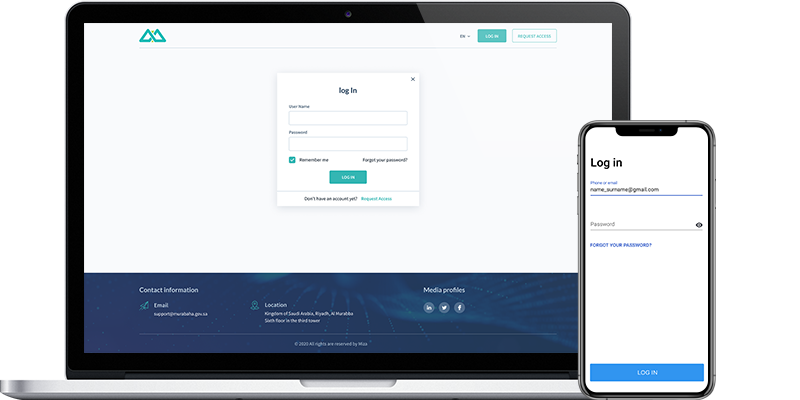

Check how we build mobile appsCustom web portal development

Investor portal software is a central hub for all financial activities. Our team specializes in developing custom web portals that give users a comprehensive overview of their investments, asset allocation, and financial planning. These portals feature interactive dashboards, detailed reporting tools, a clean and minimalist design for ease of use, and secure communication channels. The aim is to offer a seamless online experience where users can access all their financial data and tools in one place.

Explore our web portal development servicesArchitecture design

The foundation of any software solution lies in its architecture. We emphasize creating robust and scalable architecture designs that handle financial data while ensuring decent performance. Our team evaluates each client’s needs, considering factors such as data security, scalability, integration capabilities, and future growth potential, to construct an architecture that best suits their scenario. The resulting architecture is resilient and future-proof, ready to adapt to the ever-evolving financial landscape.

Get software architecture servicesLegacy system modernization

Relying on outdated systems can hinder growth and efficiency. Legacy systems, once the backbone of many financial operations, can now pose challenges to compatibility, security, and functionality. Our legacy system modernization service aims to transform these older systems into modern, agile platforms. We ensure a smooth transition, retaining critical data and functionalities while introducing contemporary features and integrations. The result is a system that aligns with technological standards, offering enhanced performance.

Get consulting on system modernizationDigital channel implementation

The digital revolution has reshaped the way we interact. Today’s consumers expect seamless digital experiences through web investor portal solutions or mobile apps. Our digital channel implementation service focuses on creating these platforms for wealth management and investment operations. We design user-centric channels that offer intuitive interfaces and real-time data access. By implementing these digital channels, businesses can cater to the modern client’s needs, fostering engagement and trust.

Software audit

Ensuring that systems are efficient, secure, and compliant is paramount in the financial sector. Our audit service provides a comprehensive review of your existing software solutions. We evaluate their performance, security protocols, data handling, and compliance with industry regulations. Any vulnerabilities or inefficiencies are highlighted, and we provide actionable recommendations for improvement. This audit ensures that software systems are up to par and identifies areas for potential enhancement.

Discover our software audit servicesOur approach to wealth management software development

Developing fintech software requires a meticulous and client-centric approach. At the heart of our services lies a commitment to understanding each client’s unique needs and crafting solutions that resonate with their objectives.

Here’s a step-by-step guide on how to start a collaboration with us:

Our tech stack

About DICEUS

Our achievements

Our case studies

Testimonials

Frequently asked questions

What are wealth management and investment software development services?

Wealth management and investment services encompass a range of financial services designed to assist individuals and institutions in managing their wealth. This includes but is not limited to, financial planning, investment advice, tax planning, and estate planning. The primary goal is to grow and protect assets over time.

What is the difference between wealth management and investment services?

While both fall under the financial services umbrella, there are nuances. Investment services primarily focus on buying and selling securities, offering advice on portfolio construction, and managing assets. On the other hand, wealth management offers a more holistic approach, addressing a wider range of financial needs, from retirement planning to tax strategies.

What is the difference between wealth management and banking?

Banking refers to basic financial services like savings accounts, loans, and credit facilities. Wealth management, however, is a more comprehensive service, focusing on long-term financial planning, investments, and wealth preservation strategies. While banks may offer some wealth management services, they are distinct from their core banking functions.