Mobile banking app development

Professional mobile banking application development, with solutions driven by technological expertise and proven skill, opens new ways to boost business performance and expand user outreach.

This is exactly what we offer at DICEUS, powering and supporting all angles of a tailored banking app development process with the latest technologies, optimal feature selection, target audience study, and full coverage of your business requirements.

We build various mobile banking solutions for any scale of operations and purpose, enabling secure transactions, сontactless payments, personal finance management, and more mobile opportunities for banks, stores and businesses, financial service providers, and financial institutions of all sorts.

Do you need a new app for your bank or financial business? DICEUS is a banking app development company that listens to your business needs and delivers a fine-tuned range of mobile app development solutions and services.

DICEUS is a global technology partner for banks, one of a few dedicated mobile banking app development companies. You can get various solutions, including the banking app development of iOS and Android products with core mobile banking features. We also optimize legacy systems, upgrade them, add new modules, change applications to make them compliant with central banks’ regulations, design architecture and UI/UX, migrate data, and do software audits and business analyses.

You can check a few typical services related to banking app development from our offerings. You can get any requested feature or module added to your digital application. While traditional mobile banking app development companies create similar products for the masses, we praise a personalized approach.

Anti-fraud modeling

Mobile apps should be secure. We offer custom anti-fraud tools, reports, monitoring modules, as well as upgrades to meet new rules from central banks.

System architecture

You can get improved modules so your internal experts will be able to add new processes or change existing ones in the shortest time possible.

UI design

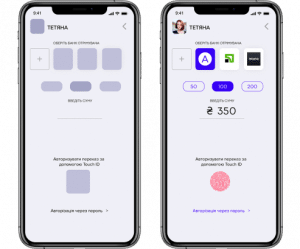

This service makes the general look and interface of your mobile banking system polished and user-friendly for excellent user experience.

UX design

Apart from UI, we provide UX services. They ensure that your application is understandable and that clients can find everything they need quickly.

Mobile banking app development is crucial for financial institutions. As customers become more dynamic, they prefer to access core services through apps. Even websites are becoming less in demand because people focus on the smooth native experience. When your clients can check balances, send money, pay bills, or find ATMs in a few clicks, they appreciate your effort. Hence, mobile banking software is one of the best investments you can make right now.

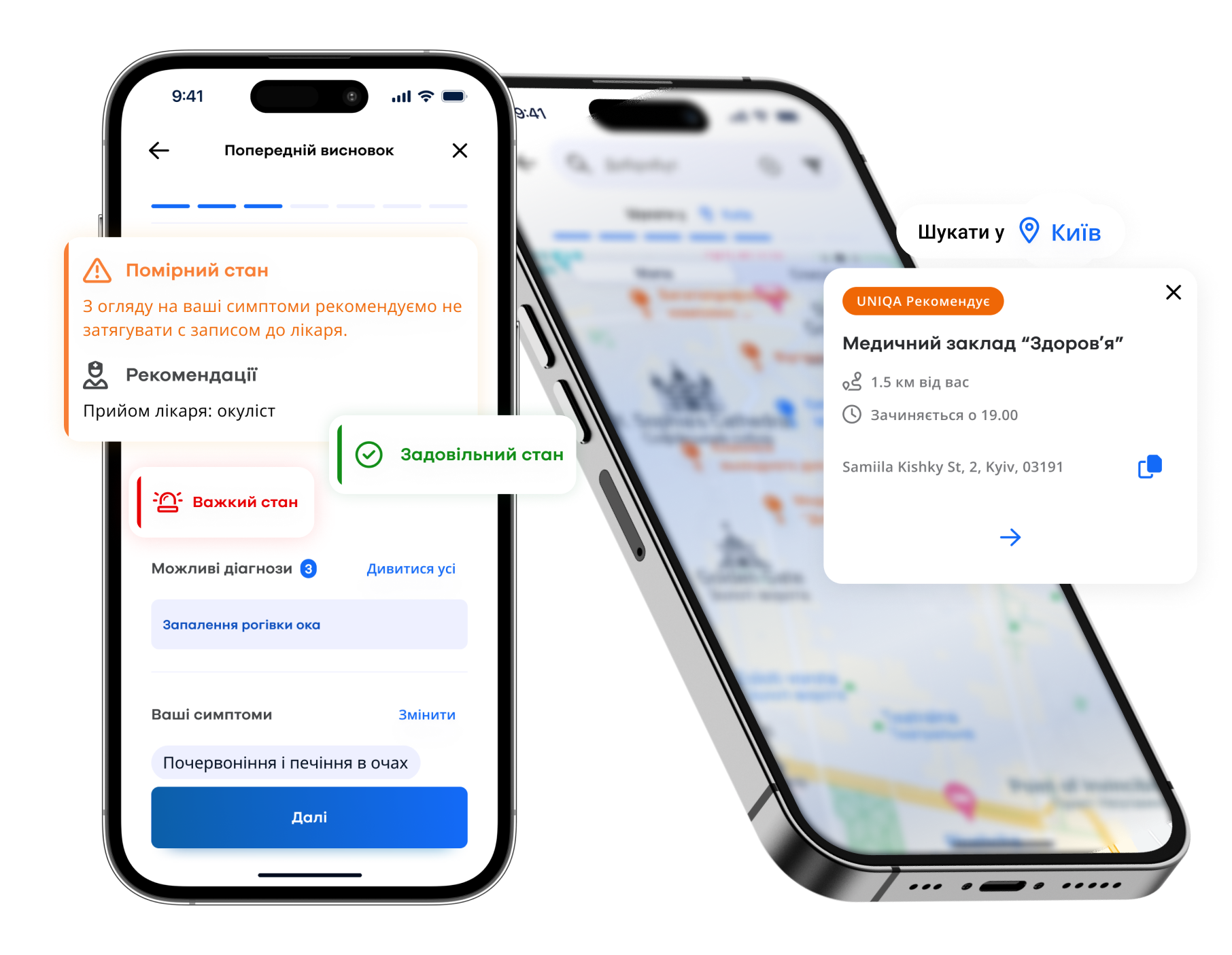

Mobile banking features

- Registration. Enable fast onboarding for mobile users with a well-integrated, simple registration feature to achieve higher rates of customer acquisition.

- Identification. Offer secure and quick user identification with biometric authentication and anti-fraud security mechanisms, enabling customers to access their accounts easily for ultimate business efficiency.

- Deposit application. Simplify the deposit process in your banking applications to boost deposit volumes and improve liquidity management.

- Card application. Provide an intuitive card application process that boosts cardholder adoption and engagement.

- Card management. Allow users to easily manage their cards and minimize support requests with the help of push notifications, real-time account management, and intuitive customer tools.

- Loan application. Streamline loan applications through a user-friendly mobile app to encourage higher loan uptake and enable smooth processing of loan applications.

- Loan repayment. Provide convenient loan repayment options to stimulate timely repayments and lower the potential for delinquency risks.

- Money transfers. Facilitate secure, fast money transfers and P2P financial operations with a mobile application tuned for growing transaction volumes.

- Money withdrawals. Enable easy access to cash withdrawals and digitize your nearest service point, boosting convenience and granting high customer satisfaction rates for mobile users.

- Payment templates. Save users time with reusable payment templates, encouraging repeat transactions and improving retention.

- Bank communication. Enhance customer service by enabling direct communication with bank representatives, doubling down on trust and responsiveness.

- Spending tracking. Provide real-time spending insights for users, helping them manage their finances effectively while offering more opportunities via, e.g., custom investment apps.

- Currency exchange. Enable quick and convenient currency exchange in your banking application to generate fee revenue while enhancing the user experience.

- Money transfers by phone number. Simplify money transfers by phone number to boost mobile transactions and engagement.

- Mobile phone refill. Offer quick mobile phone refills, expanding your app’s utility potential and generating extra revenue.

- Payments of utility bills. Simplify utility bill payments through a mobile app to provide value-added banking services and improve retention.

- Payments for services. Enable users to pay for services quickly and easily, expanding your mobile app functionality.

- Tax and budget payments. Streamline tax and budget payments, providing everything a modern user needs under one roof for boosted loyalty and engagement.

- Invoicing. Empower profitable digital transformation with automated smart invoicing to attract business users and achieve new revenue opportunities.

- Payee verification. Guarantee secure payments with payee verification based on advanced security mechanisms like biometric authentication, cutting transaction errors and boosting fraud detection.

- Access for employees. Enable secure employee access to your banking applications for high-performance internal processes and ultimate business efficiency.

- Salary management. Automate payroll management with salary tools and automated account management for stress-free user experiences that generate ROI.

Can’t find the feature you need?

Send us your requirements and we’ll contact you soon to discuss the required features.

Send requirementsWant to discuss your project?

Book a callBenefits of mobile banking app development

Let’s be honest: you don’t need a fintech mobile app in your bank if you don’t want to fight for the customers. And we mean fierce and 24/7 competition with many other market players. That’s why basic mobile banking application development doesn’t work. People want the best of the best.

If you’re ready to get a solution to attract, convert, and retain clients, both SMEs and individuals, just drop us a request. We’ve designed dozens of applications for banks from Europe, the USA, and the Middle East. And we know what people really need:

Our mobile banking development process

With us, you get a reliable and standard-driven approach combined with professional mobile banking app developers. According to the dev lifecycle, we start any project with an initial analysis. This stage helps us to understand your business better to deliver exactly what you need. After requirements gathering and planning, we design, develop, test, and implement the application. Upon request, our mobile banking app developers can change the approach to speed up certain phases or dedicate more time to them.

In both cases, you get your online banking system designed, developed, and updated according to your unique needs. We guarantee that our solutions include all the key functionalities and have an attractive and user-friendly design. Moreover, after deployment, you can add or change features or other modules quickly to introduce new services, adjust existing ones, or comply with regulations.

Actual service delivery processes are standard-based and stable. Traditionally, we start with the business analysis phase to gather your requirements and understand your business needs. Further, we design architecture and UI/UX, develop the online banking system itself or upgrade existing modules, test everything, deploy, and support online banking solutions. The flow can be changed upon request. For example, we can speed up everything if you want to launch software faster.

About DICEUS

Our achievements

What impacts your project duration

To develop or upgrade any mobile banking software, we need from 6 to 9 months on average. Exact terms vary greatly. You can get a small project with a few updates to your existing app completed much faster than a complex one with custom development from scratch. The more features you need, the longer it takes to develop them, as a rule.

- Project requirements

- Expected deadlines

- Team composition

- Chosen technology and platforms

What affects your project costs

Mobile banking solutions can be different in terms of scope and complexity. Costs can be different, too, respectively. Here are the core factors that affect the total cost:

- Project scope and complexity

- Chosen technology

- Project completion urgency

- Engagement model: Fixed Price, Time and Material, Dedicated Team

- API availability and the number of secure integrations

What we need from your side

As long as the majority of banking processes rely on core banking systems, it’s crucial to prepare your API. Hence, your primary responsibility is to provide access to API integrated with the core banking platform. Furthermore, it’s a good idea to provide at least two team members from your side to ensure knowledge transfers and efficient communication.

- Project goals, vision, and roadmap if exist

- High-level project requirements

- Project-specific documentation if available, for example, a test strategy or test cases

- Client’s availability (a couple of hours per week for requirements gathering sessions)

- Project deadlines

Our SDLC

Discovery phase

Architecture and design

Development

Testing and QA

Deployment

Maintenance

Our tech stack

Explore our case studies

Testimonials

Frequently asked questions

What is a mobile banking application?

It’s a fintech solution designed for mobile devices like smartphones or tablets. Mobile banking app developers create such digital tools to provide banking functions through mobile channels. Via mobile apps, users can interact with the bank, check accounts, transfer money, access other available banking products like deposits, loans, etc.

What are the types of mobile banking?

Apart from banking app development, there are more mobile options that provide access to banking services. These include SMS and USSD connections through which users can receive and send text messages. As well, banks can create mobile-optimized versions of their websites to provide services without dedicated mobile apps.

How do you develop mobile banking apps?

Our mobile banking app developers have experience in modern and innovative technologies and industries. We build various modules, including AI-based services, RPA for banks, advanced data warehouses, etc. Depending on your requirements, we change banking app development processes and suggest the most efficient technologies.