Professional payment software development services delivered by seasoned experts with a passion for creating unique, custom payment and other software solutions will give you that sturdy competitive, business, and tech edge.

We are taking things far beyond e-commerce needs only. You can easily enable recurring payments on any website, platform, or mobile application.

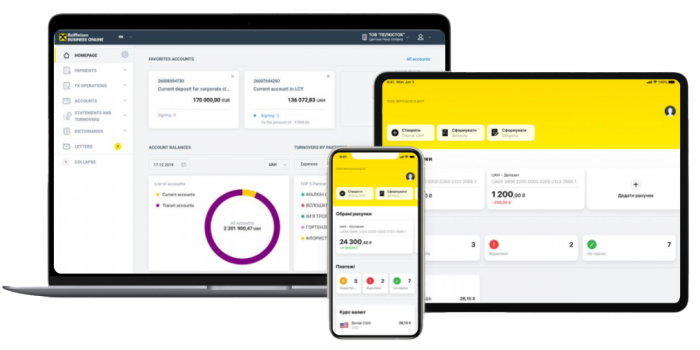

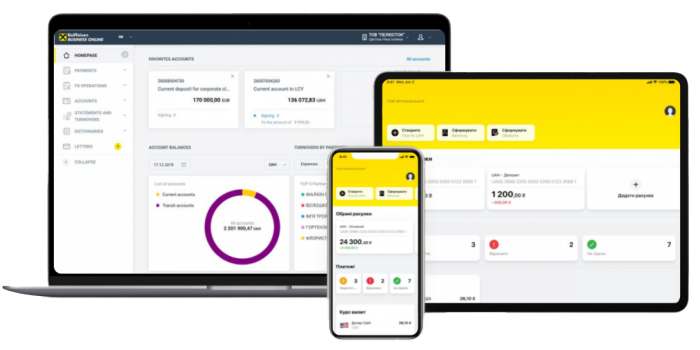

We create desktop, cloud-based, mobile, and hybrid solutions. Designed for your target audience and efficiently implemented mobile payments will bring you closer to your customers or users during the startup phase and further.

With an unlimited reach of the integration services we provide, you get a reliable technology partner ready to empower, optimize, and boost your business or startup across all angles. In particular, we can handle seamless payment gateway integration on a budget, according to the latest tech trends, consulting you all the way on all complex and confusing terms and methodologies.

Payment software development services we provide

As a long-time expert in delivering high-end payment software solutions, DICEUS has sufficient skills and a cutting-edge tech stack to cope with any project in the realm of online payment software. The scope of services we provide can cover every need an organization may have regarding software for payment processing, management, and fulfillment.

Learn more about how we can help you in payment software development.

Our expertise

- Over 250 competent and certified professionals have accumulated extensive experience during 14 years of delivering IT products and services.

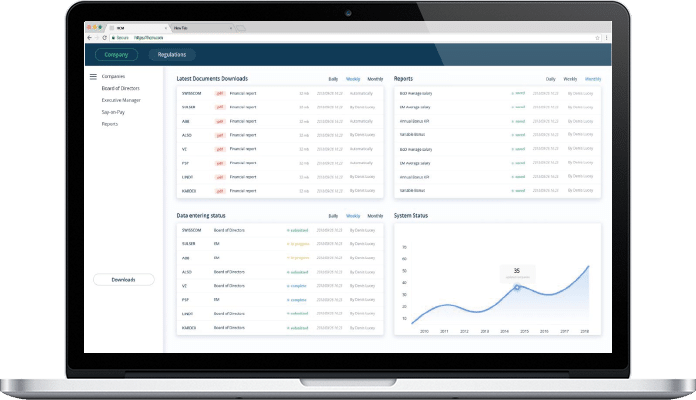

- We completed multiple payment software projects working for fintech, banking, retail, logistics, healthcare, e-commerce, and other organizations.

- Utilization of cutting-edge tech stack containing the most efficient back- and front-end tools, programming languages, and the latest know-how (AI, ML, blockchain, Big Data, IoT, etc.).

- Our focus is on security and AML compliance, which are mission-critical for payment processing software that must be fully protected from any malevolent activities and fraud attempts.

- Exceptional client-centricity of our approach, allowing us to deliver solutions tailored to satisfy all customer requirements, which play well with other professional software they use and have a considerable upscaling potential.

- Adaptability and flexibility of our cooperation style when we meet our partners halfway in setting up communication sessions, establishing interaction channels, and offering engagement models.

Can’t find the service you are looking for?

Explore all servicesWant to discuss your project?

Contact usOur development process

One hallmark of a solid and reliable IT vendor is the well-established SDLC they have for different solution types. We at DICEUS have a time-tested strategy in place that enables us to swiftly develop high-quality payment software.

How long does it take to develop a payment solution?

As a serious IT vendor, DICEUS never hurries to make short work of any software project, especially if it is a payment solution. We will deliver the product according to the timeframe, which can be established when we know:

- Project requirements

- Expected deadlines

- The size and composition of the project team

- Technologies the project implementation requires

- Change requests

How much does it cost to develop a payment solution?

It is no chump change issue, yet it doesn’t have an exorbitant price tag on it either. A precise sum can be announced after we take into account the following details.

- Project scope and complexity

- The urgency of project delivery

- The tech stack involved in the project

- Engagement model you prefer (Dedicated Team or Time & Material)

- Integration needs

Our tech stack

Our cases

Testimonials

Which organizations gain from developing custom payment software?

Tailored payment software development services give a felt boost in performance, outreach, and RoI to companies and agencies, SMBs and enterprises, startups and individual projects that tap into any relevant niche or industry. The professionals at DICEUS have been delivering products of all scopes and tailoring services to clients coming from fields like:

E-commerce platforms

- Accept and process payments in any required currency to cater to a global customer base with multi-currency support and processing.

- Integrate your existing or newly developed eCommerce platform with popular payment gateways like PayPal, Stripe, and Square.

- Automate recurring payments for subscription-based products or services with smart subscription billing.

- Implement machine learning algorithms to pinpoint and prevent fraudulent transactions through intelligent fraud detection, KYC, and AML tools.

- Allow multiple parties (e.g., vendors and suppliers) to receive payments from a single transaction through split payments.

Retail businesses

- With Point-of-Sale or POS software development, store owners and managers can combine inventory management, sales, and payments into a single POS system.

- Enable contactless payments via NFC, QR codes, or mobile wallets, both digitally and in a brick-and-mortar store, via a unified POS terminal.

- Connect payment systems with loyalty and rewards programs to encourage repeat business and grow that RoI.

- Manage and process digital and physical gift cards automatically and in a personalized manner, boosting customer loyalty dramatically.

- Offer customers in-store financing solutions at the point of sale.

Financial institutions

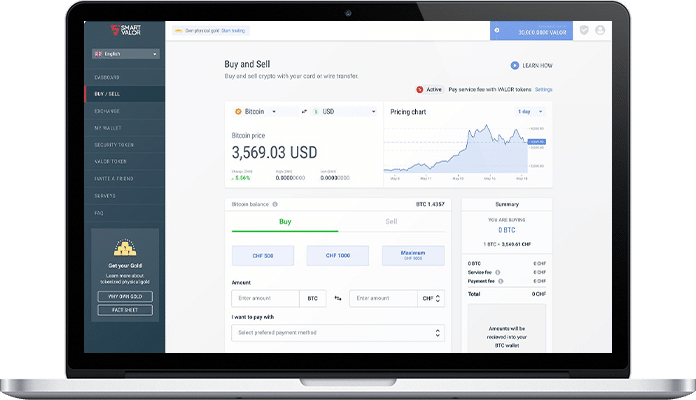

- Online banking portals developed just for your brand grant a secure, user-friendly digital portal experience for hassle-free, personalized online banking.

- Real-time payment processing software implemented from scratch or for your existing systems will process payments instantly, improving cash flow all around.

- Risk management tools powered by AI and big data analytics will allow you to assess and mitigate payment-related risks.

- Cross-border payment processing solutions that we can develop provide seamless international payment solutions with lower fees and faster processing times.

Healthcare providers

- Custom patient payment portals offer secure digital environments where patients can easily pay their bills online.

- Payment plan management provides patients with flexible payment plans for costly treatments.

- We also develop telemedicine payment solutions, integrating convenient payment options within telehealth platforms for fast and simple transactions.

Travel and hospitality

- Integrated booking and payment systems developed for your business can handle both reservations and payments seamlessly.

- Start offering guests the instantly sought-after ability to pay for services via mobile wallets and apps.

- Software-powered customer refund management automates the process of issuing refunds for canceled bookings.

Subscription-based services

- Customer self-service payment portals allow customers to manage their subscriptions and payments online.

- We also create personalized tools to manage subscription tiers, billing cycles, and renewals.

- Automate the generation and distribution of invoices and receipts through AI and custom software automation.

Non-profit organizations

- We create crowdfunding platforms for fundraising campaigns, integrating payment processing for convenient and fast donations.

- Membership payment systems help manage member dues and renewals with automated payment systems.

- Grant disbursement systems automate the distribution of grants and track fund allocation and online payments.

Real estate

- Integrate payment systems with property management software for easily tracked operations assisted with automated reminders and custom alerts.

- Deposit management systems we build help manage security deposits with automated tracking and disbursement.

- Lease and contract management can also be automated and streamlined via platforms for handling lease agreements and payment schedules.

Transportation and logistics

- Fleet management payment systems automate payments related to fleet management, including fuel, tolls, and maintenance.

- Cross-border payment solutions facilitate international online transactions with multi-currency and multi-language support.

- We can also develop driver payment systems and custom platforms for automated payments to drivers and contractors.

Insurance companies

- Premium collection systems help automate the collection of insurance premiums with flexible payment options.

- Claims payment systems facilitate the disbursement of insurance claims with automated payment processes.

- Policy renewal payments can be equipped with automated payment reminders and personalized systems for policy renewals.

- Agent commission payment systems that we develop enable the automation of commission payments to insurance agents.

FAQ

What are payment software development services?

These are called to cover all needs of an enterprise related to the creation of various payment solutions. A competent vendor typically provides the development of custom payment processing solutions, applications, and gateways, EMV integration, and POS products that accept contactless payments. Special offers in the niche include fraud protection solutions and guaranteeing PIC DSS compliance.

Why do businesses need payment software development services?

Money transfers are the blood of the global economy, whose fast and unimpeded circulation is the bedrock of its robust functioning. In the 21st century, payments are mostly made via digital channels enabled by specialized software. The design and development of payment solutions is a no-nonsense endeavor that can be entrusted only to high-profile mavens with profound expertise in delivering such services.

Is payment processing a SaaS?

It is one of the options which promises weighty perks to companies that go for it. By subscribing to it, organizations regularly receive invoices according to their package and choose the method they are comfortable with to pay for the services. Such an approach allows for easier accounting, more efficient billing, and broad flexibility in pausing, renewing, upgrading, or downscaling the subscription plan.

How long does it take to develop payment software?

The timeline for a payment software development project is dictated and shaped by the complexity of the project, the number of features required, and the level of customization needed. On average, a basic payment solution may take 3 to 6 months to develop, while more complex systems with advanced features like multi-currency processing, fraud detection, and integration with third-party platforms could take 6 to 12 months or longer. The development process includes phases such as discovery, design, development, testing, and deployment.

What industries benefit the most from custom payment software?

Custom payment processing software is highly beneficial across all sorts of industries, including e-commerce, retail, banking, healthcare, hospitality, logistics, and more. Each of these sectors relies on efficient, secure, and scalable payment functionality to manage transactions, maintain customer satisfaction, and comply with industry-specific regulations. For instance, healthcare providers can automate billing processes, while e-commerce platforms can offer seamless multi-currency payments to global customers.