Fintech application development expertise

Reliable fintech app development services delivered by the DICEUS team enable automation, productivity boost, and higher user engagement for banks and lenders, payment processors and e-commerce stores, insurers, investors, real estate firms, and other companies working with finance.

To guarantee those opportunities and more, including the benefits of custom development and smart integration of cutting-edge technologies, we design, build, and optimize all sorts of fintech apps based on scrupulous analyses and well-adjusted collaboration.

Turning to a proven fintech app development company like DICEUS, you get a full range of fintech software development services from consulting and planning to coding, deployment, and launch of mobile banking apps, wealth management apps, investment apps, and more types of fintech solutions.

What we offer

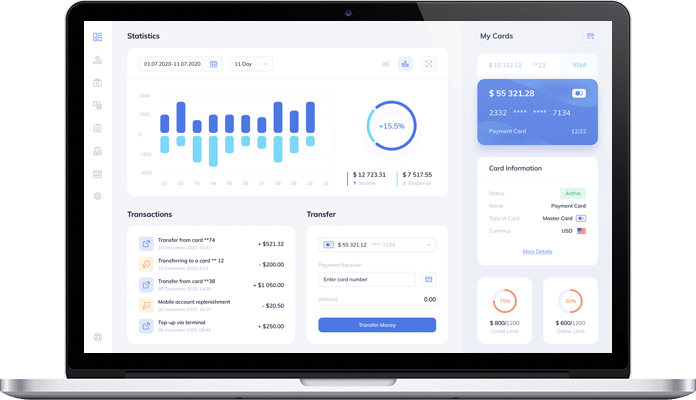

Mobile banking apps

Our financial app development company builds mobile banking apps, which are all within your online banking capabilities and provide account information, transactions, investments, support, content services like special offers, and related news. Our fintech app development experts use the latest technologies to build applications with excellent user experience to help banks and financial institutions retain and attract customers in times of high competition.

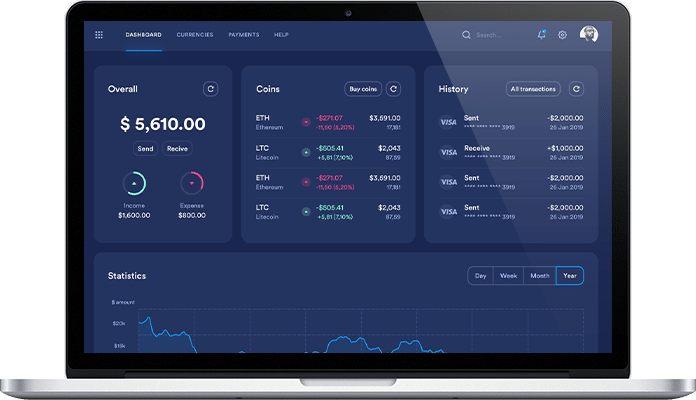

Payment applications

Our fintech app development services include UI/UX design, custom development, testing, and integration of iOS and Android contactless payment apps for retail, scheduling payment apps for lending, and blockchain-powered apps for secure P2P transactions. We also have expertise in mobile-browser payment apps, in-built mobile payment apps, mobile and wireless credit card readers, mobile wallets, and contactless payment apps.

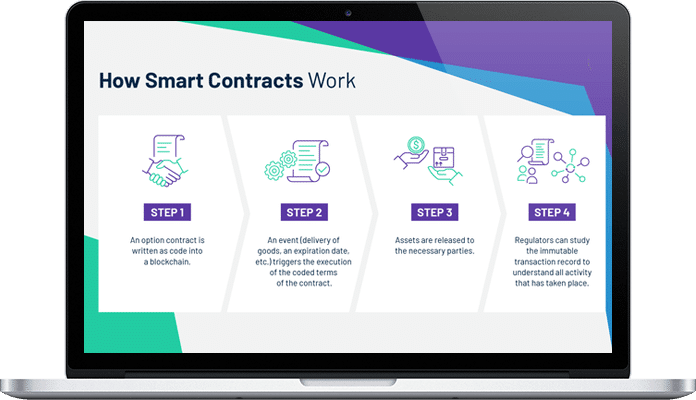

Blockchain applications

Blockchain is a powerful technology used by many industries nowadays. Fintech leverages the blockchain benefits for Know-Your-Customer (KYC) processes, supply chain management, payments, credit scoring, records storage and management, and many more. To build a blockchain application, we have expertise in Hyperledger, Corda, Solidity, Quorum, MultiChain, Eris Industries, Ethereum, Ripple, etc. If you have any other tech stack needs, please contact us.

Finance management

We have experience building and integrating financial management software and web and mobile applications for internal organizational use, empowered with core functionalities like business intelligence, planning, managing, monitoring, and controlling financial assets. We can either build a custom fintech app from scratch or integrate a ready-made solution with your existing IT infrastructure. Besides, you can get a free 30-minute consulting concerning your fintech project.

Loan lending applications

With feature-rich and user-focused loan lending applications built by DICEUS specialists, you can facilitate both daily personal loans and complex business financing management. Namely, such software automates loan application assessments, credit scoring, and approval workflows, enabling faster service delivery at lower operational costs. We build peer-to-peer lending apps, microfinance apps, payday loan apps — you name it.

BNPL (Buy Now, Pay Later) apps

BNPL apps can help you reinvent consumer finance by giving your customers the freedom to purchase goods right away and pay for them in installments or other convenient manners over time. A custom BNPL app grants an organic boost for sales conversion rates through inviting and customer-tuned user experience. We develop BNPL platforms with robust credit assessment engines, seamless integrations with eCommerce systems, and user-friendly UX/UI.

Get professional consultating to develop a unique fintech app!

Benefits of financial application development

Fintech advancements help businesses in many industries reach new values, improve customer experience, provide securer and faster services, deliver high-quality customer support. Fintech innovation presented a new different path to gain a competitive edge. Our fintech app development company will be happy to help your business understand how you can harness the latest technologies to improve the efficiency and flexibility of your processes, products and services.

We provide a wide range of IT services for various industries!

Explore all servicesWant to discuss your project?

Send your requirements for our team to offer you the most effective solution.

Contact usOur financial web development process

Specialists at DICEUS leverage years of experience and continuously expanded, relevant expertise to guarantee an individually tailored, smoothly adjusted workflow for your new fintech app development project. We keep it responsive, transparent, and efficient in order to deliver high-quality digital products on time and on budget.

What impacts your project duration

The total duration of a fintech project is affected by many factors, including your project’s tech stack, team size, and overall scope of complexity. The most important individual duration-shaping aspects are.

- Project requirements

- Expected deadlines

- Team composition

- Chosen technology and platforms

- Type and complexity of a blockchain solution

What affects your project costs

To estimate the cost of a fintech project, we consider a lot of things, from the depth of technical skill required to the extent of specific services we’ll need to provide. The price-forming essentials include the following.

- Project scope and complexity

- Chosen technology

- Project completion urgency

- Engagement model: Fixed Price, Time and Material, Dedicated Team

What we need from your side

We will need some information from your side, I.e., your goals and vision that are crucial for the appropriate planning. Based on that, we will create a software specification document. We appreciate it if you provide us as much data as possible.

- Project goals, vision, and roadmap if exist

- High-level project requirements

- Project-specific documentation if available, for example, software architecture and mockups

- Client’s availability (a couple of hours per week for requirements gathering sessions)

- Project deadlines

About DICEUS

Our achievements

Which organizations gain from developing custom fintech software?

Custom fintech software development grants digital foundations for SMBs and enterprises, induces startups with the power of innovation, and enables more opportunities for more industries and types of providers operating in them.

Banks and neobanks

- Traditional banks and credit unions can start offering mobile banking, digital wallets, peer-to-peer payment systems, and other modern financial services, gaining a competitive edge.

- Digital-only banks can get the capacity to provide full-scope banking services without outdated brick-and-mortar branches.

- Startups can create niche banking solutions focused on specific demographics or underserved markets.

- Investment banks can develop trading platforms, robo-advisors, or analytics tools for their clients.

Payment processing companies

- Companies that handle online transactions, payment gateways, or point-of-sale (POS) systems can streamline financial processes throughout.

- Businesses can integrate innovative payment solutions like contactless payments, QR code payments, or blockchain-based transactions, automating essential business processes.

Insurance companies

- Insurers can reap the benefits of tailored insurance app development with solutions for policy management, claims processing, customer support, and premium payments.

Investment and wealth management firms

- Firms can digitize and automate investment advisory, portfolio management, and stock trading, as well as build new cryptocurrency trading platforms.

- Robo-advisory services can be implemented and integrated to provide algorithm-driven automated financial planning and investment strategies.

E-commerce and retail businesses

- Companies can easily start offering in-app purchases, integrate financing options like buy-now-pay-later (BNPL), and expand their payment solutions.

- Retailers can also create loyalty apps or feature-rich digital wallets.

Cryptocurrency and blockchain companies

- Businesses can enhance their grasp on digital currencies through custom blockchain-based payment systems or decentralized finance (DeFi) platforms.

- DICEUS creates exchanges, wallets, and platforms that allow users to buy, sell, and manage cryptos.

Real estate and proptech providers

- Firms can design customizable mortgage calculators, property investment platforms, and individual rental management tools.

- We can create real estate marketplaces integrated with fintech solutions for secure payments, fractional ownership, or property financing.

Our tech stack

Explore our case studies

Testimonials

Frequently asked questions

What kind of financial app does your business need?

It all depends on your industry or niche of operation. If you don’t have one yet, we can help you decide which market segment is the most fitting to occupy for you. We can also help you conceptualize if you only have the need or demand for a fintech software product but lack the expertise and skill for its design and implementation.

If you have any ideas on a fintech app for your business, it’s great. However, if you have any doubts, it can help you, contact our fintech team and get free consulting. We will develop a strategy in which you will see how modern technology can help your business grow, including business values, the right technology stack, the right resources, roadmap, and work breakdown structure.

What is the best language to build a fintech app?

Today, Java and Python are considered the best programming languages to build a fintech app. However, language choice will mainly depend on the project’s specifics and complexity. Our tech leads will consult you on the best suitable tech stack for your fintech application development, whatever it will be, a mobile app, a web app, or a complex banking system.

We can also create custom tools, integrations, plugins, and APIs for specific purposes, like expanding and customizing an existing app, connecting new software to legacy solutions, and more. If you already have a development team, we can help you train, augment, or expand it to close expertise gaps and boost performance.

How much does it cost to build a banking application?

The cost of any project depends on its complexity and scope. Also, the chosen technology and platforms make a difference. Our specialists can estimate the cost of your project based on your requirements and business analysis, highlighting the most closely approximated cost range based on the choice of technology, approaches/methodologies, and timeline.

More than that, we can help you cut excess where possible and minimize hidden or unnecessary extra expenses through an efficient workflow, in-depth project analysis, and guaranteed post-project RoI. We prioritize reasonable cost bars and are ready to go the extra mile for you.